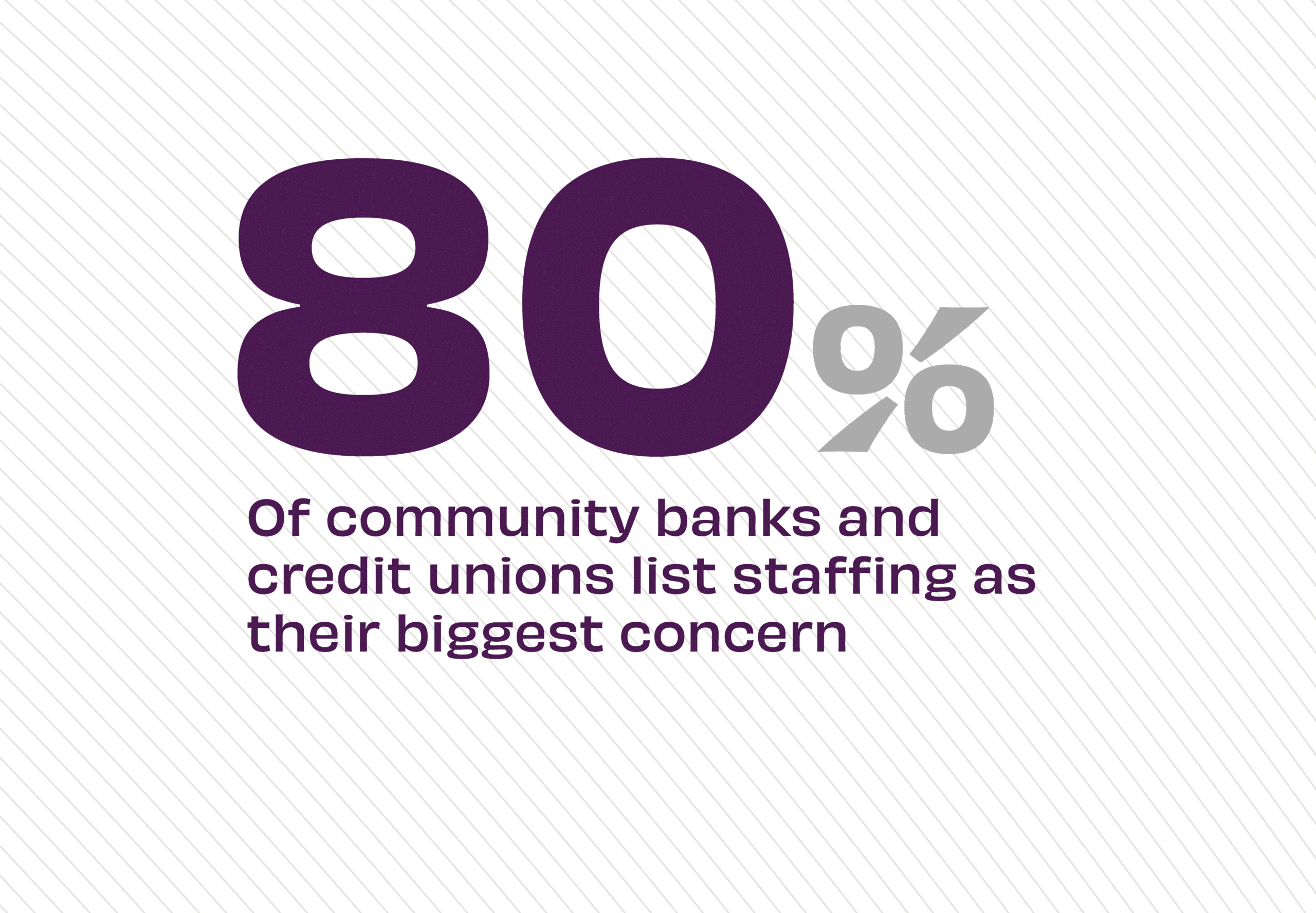

The Story:

Community financial institutions say they’re challenged to find the find the right staff for the right roles, according to data from Rivel Banking. Given that one out of five staff leave their positions, banks and credit unions must do more to attract and retain top talent, and pay alone won’t make them stay. “Banks and credit unions have been bumping up starting salaries in an effort to lure talent during a time of record-low unemployment,” according to the Financial Brand. “But if financial institutions don’t offer programs that help employees advance their careers, staff turnover may continue to be a problem.”

The Takeaway:

Annual research from Crowe on bank compensation and benefits finds career enrichment essential to retention. “If financial institutions could start to focus on career-development plans for their employees, maybe it would help with turnover, especially since that’s the No. 1 reason employees are leaving,” says Stephanie White, senior manager at Crowe, regarding the company’s compensation research reported in the Financial Brand. Shining a light forward, the industry can take some inspiration from the nation’s Best Credit Unions to Work For competition. The list features organizations of all sizes implementing innovative strategies for attracting the next generation of professionals and keeping them enthusiastic and engaged.

Source: Rivel Banking, “Bank Staffing,” January, 2024; Financial Brand, “Higher Pay Isn’t Enough to Stem Bank Employee Turnover” November 3, 2023; and American Banker, “Best Credit Unions to Work For,” August, 2024