As younger generations take the economic reins, financial institutions must rethink their relevance to deliver digital speed, personalized experiences, and human-centered connection

The future of banking isn’t on the horizon – it’s already here. This time the revolution isn’t based on new technology, but on renewed relevance. Millennials and Gen Z are rapidly becoming the dominant economic force, with trillions in wealth transferring into their hands (and their bank accounts). This generational turnover is prompting a wake-up call for financial institutions to listen to the needs of younger consumers. “They want their financial life at their fingertips,” says Bunita Sawhney, Chief Consumer Product Officer at Mastercard. “The future of finance belongs to those who listen, evolve and build with this generation, not just for them.”

While younger consumers may be fully fluent on their mobile devices, they’re far from monolithic in their needs. To earn their trust and loyalty, financial institutions must go deeper than digital access alone. For Gen Z, especially, banking behavior is shaped by a combination of immediacy and individualism. They have a need for speed, expecting frictionless onboarding, instant payments, and rapid loan decisions – all delivered without delay. But even with their preference for self-service, they want fast access to human help when they need it. That includes live chat support, expert advice, and in-branch guidance.

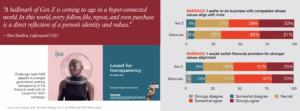

For their part, Millennials are also redefining engagement with their banks. While equally invested in tech-forward tools, members of this mobile generation place added emphasis on practicality, perks, and principles. This generation is both pragmatic and purpose driven, responding to experiences that will help them feel informed and empowered. They expect transparency around fees and features, gravitate toward financial tools that offer customization and control, and embrace brands that reflect their values. As the first generation to navigate both traditional and digital banking, Millennials bring high expectations to every interaction.

Gen Z and Millennials are navigating a crowded financial landscape, flooded with influencers, fintechs and payments companies, and generic automated advice. At the same time, both generations are seeking financial brands that reflect their values with a growing number of people willing to switch institutions for a better fit. “Banks must meet this demand by providing comprehensive needs-based services,” says Udi Ziv, CEO of Personetics, interviewed by the Financial Brand in their reporting on Millennial banking. “Companies should leverage AI-driven insights and advice to assist their customers in making smarter financial decisions.”

Increasingly, financial institutions must also consider how financial readiness relates to real-life goals. New research from the Harris Poll shows that nearly 1 in 5 Gen Zers would end a romantic relationship over a partner’s high debt and more than 1 in 3 rank emergency savings as more important than physical appearance. Reflecting a broader societal shift, these findings demonstrate a clear linkage between how people prioritize financial stability as part of overall well-being. This reality offers banks and credit unions a pathway to increase engagement through life-stage support, milestone planning, and targeted financial products and services.

Looking ahead, the influence of Generation Alpha is already beginning to take shape, with early indicators showing financial literacy and values-based decision making will continue to shape expectations and experiences for financial brands. For banks and credit unions, that means designing experiences that continue to evolve with customer needs, iterating tech-forward solutions backed by real human support – all built on a foundation of trust and transparency. “Gen Alpha is already proving to be highly values-driven,” according to a recent eMarketer report. “Building conversations around values will be essential to forging brand affinity.”

If you’re a banking leader looking for ways to deliver better banking experiences to all generations, get in touch with the experts at Adrenaline.