Investments and initiatives to reach the underbanked and underserved communities in financial services

Diversity continues to top the headlines in financial services, and with good reason. The sector still has challenges but is making strides in better serving diverse communities. Now, the government is stepping up with some support. In just the last week, the FDIC announced it’s leading a new initiative to match private investors with minority-owned banks and community development financial institutions in need of capital funding for “a wide range of development activity in underserved communities.” That’s in addition to the Treasury Department’s $9 billion investment in minority communities impacted by the pandemic.

The FDIC’s Mission-Driven Bank Fund already has initial funding of $120 million from Truist Financial, Microsoft and Discovery, Inc. and the FDIC expects to attract additional investors. With funding available to 280 minority-focused institutions, FDIC Chair Jelena McWilliams says she was inspired by television’s Shark Tank. “As I watched businesses pitch their ideas, I thought, why not have [something similar] for minority banks.” McWilliams expects investments to “make a significant impact in low-and moderate-income communities and communities of color.”

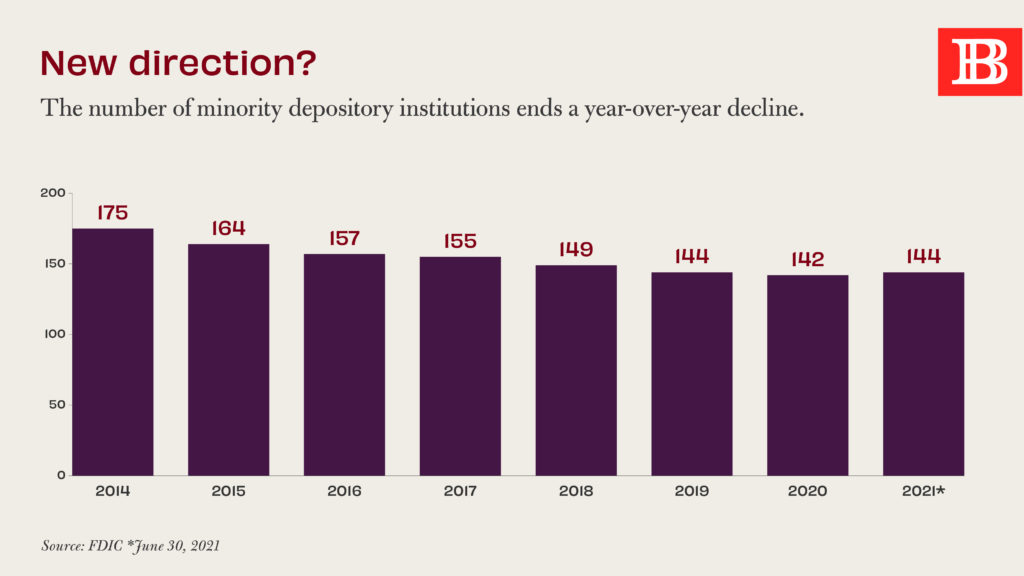

Also targeting underserved communities in Southern California, Genesis Bank announced in mid-September it had received regulatory approval for its designation as a Minority Depository Institution. According to recent coverage of the multiracial focused bank, there are more than 140 minority depository institutions in the U.S., “but only two are designated as multiracial” and Genesis is one of them. These FIs have a diverse focus in how they serve and how they’re structured. “Multiracial MDIs must meet a two-prong test: They must serve a footprint whose population is predominantly minority, and their board must be populated primarily by a multiracial group of directors.”

Looking to make a positive impact in the California communities they serve, the bank’s products and services are tailored to meet the needs of the “historically underserved minority-owned small to mid-sized businesses,” according to Genesis Stephen H. Gordon, Founding Chairman and Chief Executive Officer. “In launching Genesis Bank, we always had a commitment to serving our diverse and multi-cultural communities that represent the majority of our target markets.” He says, “As minority populations continue to grow in Southern California, they remain a larger proportion of unbanked households, which is largely attributable to a lack of financial literacy and access to fair and transparent banking services.”

In an upcoming article tracking industry news, we’ll check in on banking’s progress toward developing more diverse workforces. For more information on ways banks and credit unions are prioritizing diversity, inclusion and equity, stay tuned to Believe in Banking or contact us at info@adrenalinex.com.