How financial institutions are shifting away from fee income and focusing on delivering consumer value instead

In just the last week, Truist, Regions, Bank of America, and Wells Fargo have become the latest financial institutions to jump on the low or no overdraft fee bandwagon, joining Capital One before them. “That’s quite a shift for the big banks, who rely on these fees as huge moneymakers,” according to CNBC’s coverage of these fees. “But it’s good news for customers, who will catch a break on fees that previously cost an average of $33.58, according to a study from personal finance site Bankrate, and could be charged multiple times a day.”

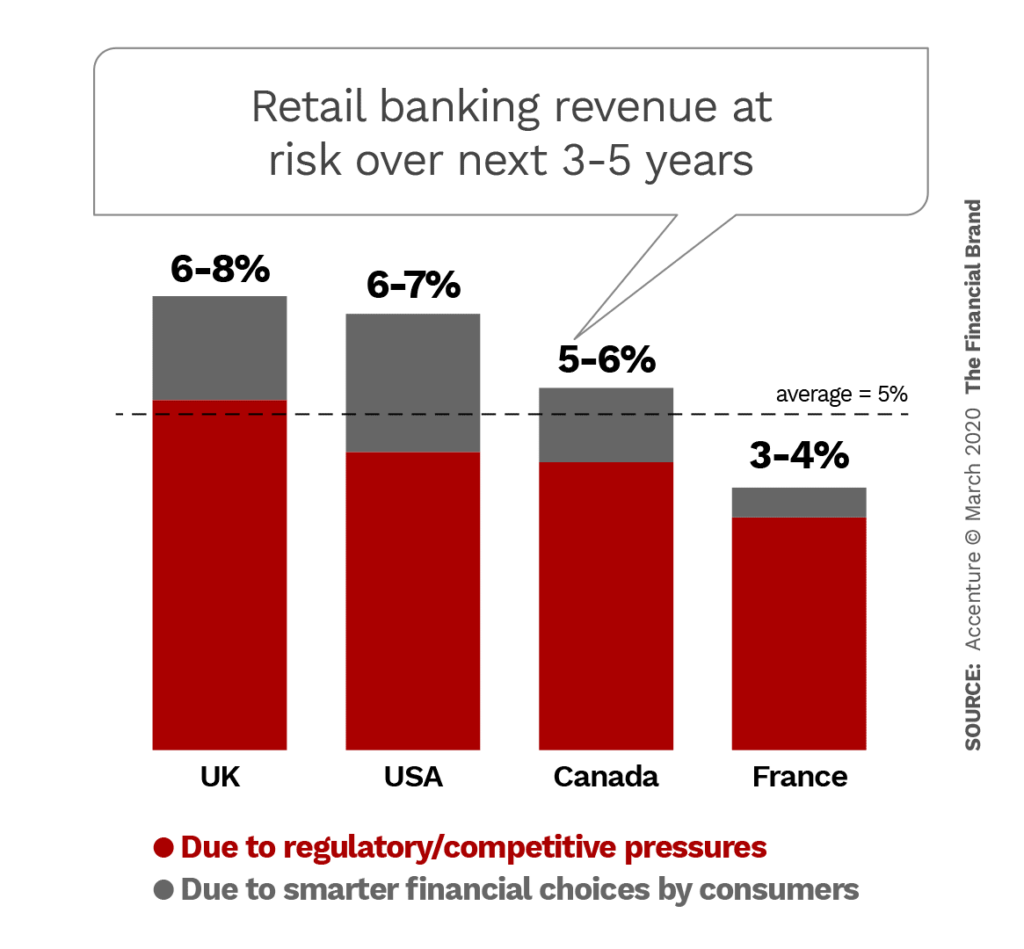

Why the exodus way from fees that provide more than $15 billion to banking’s bottom line? Consumer sentiment and government regulation are at the root of this significant shift. In December, Senator Elizabeth Warren lauded Capital One’s move to banish the fees, saying struggling families and younger generations are hardest hit by them. The Consumer Financial Protection Bureau also announced a “range of regulatory interventions” to come. Further, competition from challenger banks – like Ally and Chime that never had the fees – puts even more pressure on banks to change.

Although the regulations are likely months away, banks are smart to get ahead of the curve now. Rather than continuing to penalize the consumer with fees, smart banks are finding ways to deliver more value instead. This move away from what Accenture calls “bad income” in its report on Purpose-Driven Banking means deepening advisory services and developing financial literacy programs and new approaches to Buy Now, Pay Later and other loan and payment products that successfully leverage the continued resilience of consumer spending.

For the latest data, news and trends in financial services, stay tuned to Believe in Banking. For insights on developing smart marketing campaigns for products and services that meet consumers at the point of need, contact Adrenaline’s banking and credit union experts at info@adrenalinex.com.