More than any other channel, people go to branches to get advice, open accounts, and purchase new products

Having access to the branch remains the second most important consideration for banking customers when choosing their primary bank, according to the EPAM Continuum Consumer Banking Report 2024. The global survey found that 86% of customers have visited a branch in the last year, with 45% going to a location at least monthly. More than any other banking channel, people use branches to get advice, open accounts, and purchase new products, with six out of ten saying they “turn to branches to solve specific and complicated problems,” according to Accenture.

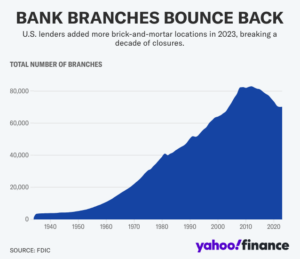

Branches are so essential for experiences that for the first time in a decade, U.S. banks added more net new branches in 2023 with no signs of slowing down. But building branches alone won’t cut it in today’s high-expectation environment. “The ever-increasing dominance of digital banking has pushed financial institutions to take a fresh look at where the branch fits into the bank’s overall customer experience,” finds eMarketer in What the Branch Means in the Age Of Digital Banking. “Banks that provide a differentiated in-person experience for needs that require a human touch are likely to see more traffic and greater usage of their branches for high-value tasks.”

How the branch functions is as essential as the staffing inside. While many industry articles tout new branch technology to make transactions faster, branches are evolving with a decidedly more human purpose at the center. “No customer who walks in [to a branch] is going to choose a machine over a person, unless the lines are incredibly long,” according to Gina Bleedorn, President and CEO of Adrenaline, in BAI Banking Strategies’ Evolution of Banking Branches. “At the end of the day, branch technology should be in service of streamlining transactions, so branches can do what they do best –support consultation, advice, and relationship-building.”

If you’re a banking leader looking at serving more and serving better, get in touch with the banking and credit union experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.