Customers expect trust and transparency from their primary financial institutions, especially when it comes to using their personal data

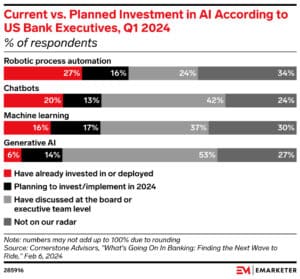

Artificial intelligence is about to make big breakthroughs in banking, with nearly six out of ten bank chief experience officers saying they’re investing in generative AI. “The implementation of artificial intelligence in the banking business has significantly enhanced client experience,” according to Forbes. “AI-powered technologies, notably chatbots and advanced analytics, have changed how banks interact with their customers, enabling degrees of customization and responsiveness that were unavailable before.” While banks and credit unions may be excited about AI’s prospects, especially for providing personalization, consumers are a little leery.

A new survey published in June edition of the Journal of Hospitality Marketing & Management finds that consumers are less likely to buy a product with AI on the label. “We looked at vacuum cleaners, TVs, consumer services, health services,” said Dogan Gursoy, one of the study’s authors and professor of hospitality business management at Washington State University, in an interview with CNN. “In every single case, the intention to buy or use the product or service was significantly lower whenever we mentioned AI in the product description.” So, while people may enjoy modern, customized products, they may not understand how providers make them.

That misunderstanding of AI extends to banking, as well. Data from the Harris Poll in February 2024 finds that nearly three quarters of customers seek more personal experiences from their banks, and 66% of respondents are comfortable with banks using their data to improve their experience. But when AI enters the chat (so to speak), consumers hesitate. “In a recent survey, 44% of banking customers were fine with their banks using AI, but many of these customers didn’t want AI to have access to their personal data,” according to EMarketer. Most want AI to be used for more anodyne activities, like fraud detection and everyday transactions.

“These findings call into question whether customers in the Q2/Harris Poll survey understand exactly how most banks would be able to offer more real-time, personalized messaging and recommendations,” according to EMarketer. While banks use personalization as a competitive edge, consumer communication is essential. “Customers want more [customization], and many FIs are implementing or considering AI solutions that could make it happen, but FIs must focus on communicating clearly and transparently with customers about how their data is being used and kept safe when AI gets access to it, and how they will benefit.”

If you’re a financial services leader wanting to deliver better banking experiences, get in touch with the experts at Adrenaline. Follow Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.