The Story:

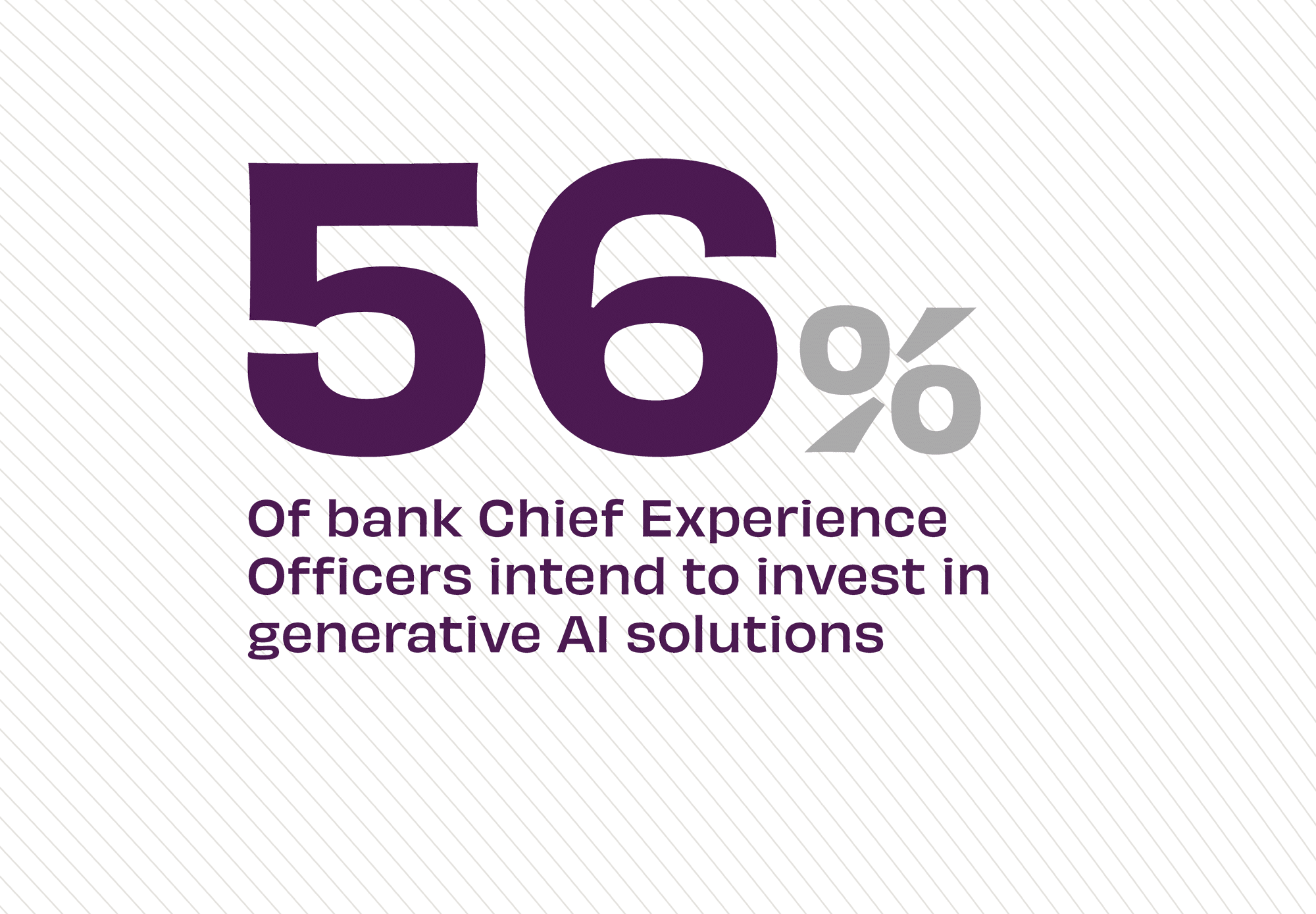

As generative artificial intelligence (AI) becomes more influential across all consumer-facing sectors, Chief Experience Officers (CXOs) for financial institutions are looking at ways to use AI to improve banking experiences. “The advent of ChatGPT and generative AI has introduced numerous off-the-shelf solutions tailored for various industries, including banking,” according to Capgemini’s World Retail Banking Report. Solutions for AI in banking include customer service, fraud detection, and compliance tools, and even more personalized programs. However, in implementing AI, institutions must decide if they want to buy, partner or build.

The Takeaway:

In the early days of their institution’s adoption of AI, banks and credit unions typically seek operational improvement, like the up to 30% productivity gains they can get out of the technology. But forward-looking institutions are focused more on experience than efficiency. “Banks use AI to help serve customers better and customers are hungry for it,” according to Juliet D’Ambrosio, Chief Experience Officer at Adrenaline in the Believe in Banking podcast. Banks are already seeing success deploying AI-driven personified and personalized tools like chatbots for customers. “They’re ultimately very valuable for customers because they’re just so helpful and they become a seamless part of your life.”

Source: Capgemeni, “World Retail Banking Report,” April, 2024, and Believe in Banking, “Age of Intelligence: AI’s Influence on Banking,” March, 2024