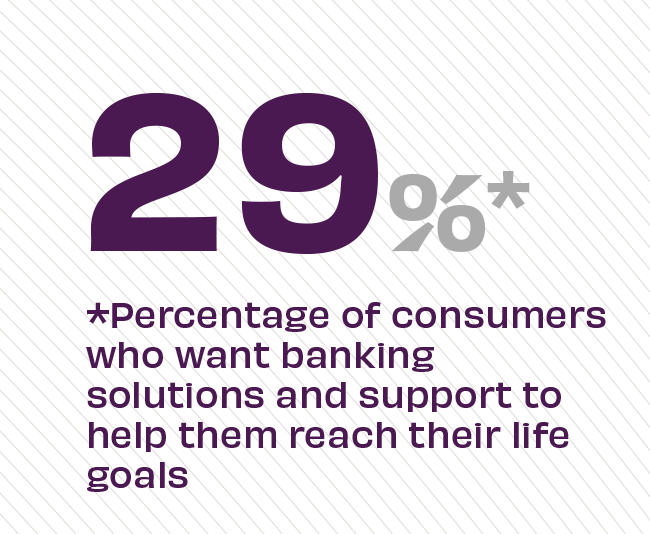

The Story:

Recent consumer data shows that nearly one in three people want their bank or credit union to think beyond banking products and provide better solutions to help them achieve their personal life goals. Even more, an additional two out of 10 customers want saving and budgeting guidance from their primary bank. This worldwide study finds people want banking to be a more human experience, going beyond transactions to provide intelligent solutions to better their lives. This more human-focused approach is called life-centricity – where each person is viewed as a multi-faceted individual with multiple influences and motivations, instead of customers with a narrow vantage point looking for a product to solve a specific challenge.

The Takeaway:

To implement a life-centric approach, financial institutions can leverage their customer data and branch staff to provide relevant solutions that are more meaningful for people’s life stages. “With a focus on personalized data, banks will be able to create products and services that clearly answer a consumer calling,” according to Believe in Banking’s article on humanized experiences. “The end result is a holistic human experience: personalized and customized offerings supported by a real people at the local branch.”

Source: Temenos, “The Customer Experience Imperative: Delivering Seamless Customer Acquisition & Onboarding Journeys,” February, 2023