How Black-owned financial institutions are serving communities with low to no access to financial services and improving the economic prospects of the underbanked

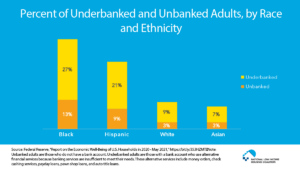

With 40% of Black adults considered unbanked or underbanked across the country, according to the most recent FDIC data, racial disparities are a persistent reality for far too many consumers and communities. Further exacerbating the situation, Black families are faced with wealth gap of more than $24,000, according to McKinsey’s exploration on investing in Black consumers. “A lack of access to financial services is both a symptom and a cause of the gap,” finds McKinsey. “Historical exclusionary policies and programs have further perpetuated this cycle.” But now, banking’s next generation is ready to pick up the mantle of support.

In their directory of Black-owned banks in America, Forbes Advisor points to institutions and programs targeted toward addressing the disparities in wealth between Black and white households. “To combat inequality, Black-owned banks have emerged across the U.S., providing economic security for disenfranchised Black communities that have long been underserved by financial institutions,” says Forbes. “Black-owned banks work to provide fair and equal services and uplift Black businesses, homeowners and entrepreneurs in ways that major white-owned banks are often unable to.”

It’s not institutional investments alone that will make a difference to the underbanked, though. Financial institutions need a deeper understanding of the lived experiences of the people they support. “A basic problem many Black communities face is that lending can require an in-depth knowledge of those communities, something traditional banks often lack,” according to the Forbes article on Black-owned banks making a difference in Black communities. For an institution to successfully serve, they need to have branches staffed with skilled bankers who live and work in the neighborhood where the bank is located.

Bringing banking to underserved communities is one way community institutions are meeting people where they are. While some community banks are opening branches in new markets, others are bringing mobile banking to areas with few brick-and-mortar branches. “Banking deserts have made financial access worse in Black communities where individuals are statistically the most unbanked and underbanked in the U.S.,” according to CNBC’s article on regional banks deploying mobile branches. “Banks on wheels are an attempt to repair the gaps within the U.S. banking landscape, which disproportionately impact Black and Hispanic communities.”

New institutions with new charters are also making waves. As one of the few credit unions affiliated with a fraternity or sorority, For Members Only Federal Credit Union has debuted in Chicago to help develop “generational wealth for the Black women connected through Alpha Kappa Alpha” according to American Banker. Another institution, Adelphi Bank in Columbus, OH is the first new Black bank in more than 20 years. “We looked at options from fintechs, to neo-banks, to credit unions and community development financial institutions,” says Kevin Boyce, co-founder, in an article in Next City. “We zeroed in on the banking platform because we felt [we should] build that as the base and we could branch out and do all of those other things as we grow.”

For more about Black banking, serving underbanked communities and how the financial industry is building banking diversity, stay tuned to Believe in Banking’s continuing coverage of top trends and topics. For the banking industry’s best practices and perspectives, like how banks can grow and serve, visit Adrenaline’s Insights. And if you’re a banking leader looking for brand-to-branch strategies customized for your institution, contact our banking and credit union experts via email at info@adrenalinex.com.