The Story:

In many ways, banks in Canada provide inspiration for institutions around the world for their business practices and processes. Now, the Canadian branch banking experience is in the spotlight, too. While the volume of branch visits are ticking downward in Canada – from 67% in 2018 to 57% in 2021 – branch usage in the country remains high and Canadian banks are slower to shutter branches than their U.S. counterparts. One reason why may be because of the experience consumers have at the branch and the value Canadian banks deliver there.

The Takeaway:

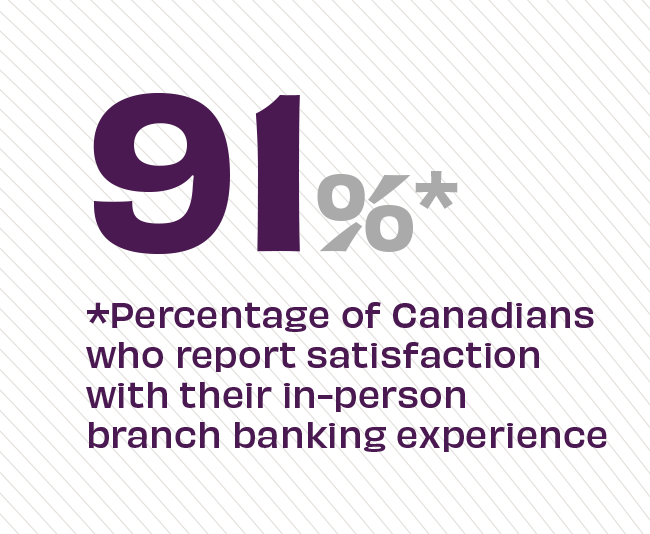

While global trends show a shift from in-person to online banking, customer satisfaction among Canadian consumers points to the continued relevance of this hyper-vital delivery channel. “Despite the surging use of digital banking solutions during the pandemic, bank branches remain an important part of the banking mix in Canada,” finds the Canadian Bankers Association. “Personal interaction will continue to play a role in our online and mobile‑first world as branches evolve into advice and information centers to help customers navigate major transactions.”

Source: Canadian Bankers Association, “Focus: How Canadians Bank,” March, 2022