New data from J.D. Power finds that consumers interact with their bank every three days

Consumers report overall satisfaction with their primary banking relationship, according to the latest data from J.D. Power’s U.S. Retail Banking Satisfaction Study. But there is room for growth and human connection plays a central role. “Retail bank customers interact with their bank every three days on average, across a combination of digital, phone and in-branch channels,” says Jennifer White, senior director of banking and payments intelligence at J.D. Power. “The tenor of those interactions has a massive influence on customer satisfaction and overall levels of trust.” Over the last year, trust took a hit, but fostering relationships can help banks build back that belief.

The role of the branch channel in creating deeper bonds cannot be overstated. “The physical presence of branch networks continues to be an advantage for traditional banks, offering a level of personal service that purely digital platforms struggle to replicate,” according to the Financial Brand’s Fintechs’ Cool Factor vs. Banks’ Staying Power. “Face-to-face interactions can be critical for resolving complex issues, obtaining financial advice and building long-term relationships with financial advisors.” Even more, while fintech leans heavily on convenience and speed, more traditional financial institutions lean on something more enduring – solving people’s problems.

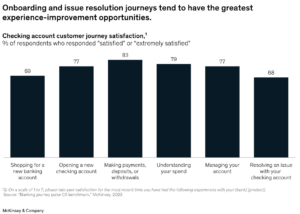

Data shows that happy banking customers not only want to stay with their banks, they want more from them, as well. “We see a positive correlation between customer satisfaction and purchasing decision – customers who are satisfied with their banking experiences say they will purchase more of that bank’s products,” according to McKinsey & Company’s article on experience-led growth. “Satisfied customers are six times more likely to say they’ll remain with a bank than dissatisfied customers are.” According to J.D. Power’s White, “Banks need to do a better job of focusing on fundamental interactions, proactively solving problems and delivering personalized advice.”

If you’re a banking leader wanting to deliver better experiences, get in touch with the banking and credit union experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.