Banks and credit unions respond to rising competition for employees by evolving roles and expanding opportunities for diverse candidates and communities

Throughout 2021, the U.S. Labor Department reported record-high numbers of employees giving notice, with 4.4 million people quitting their jobs in September alone. On its face, it may not seem like the Great Resignation would be good for competitive sectors like banking, but institutions that leverage this opportunity to attract, train and retain better talent for better jobs will create a stronger, more resilient workforce ready to deliver the kinds of experiences consumers expect.

With the competition heating up, banks are making jobs more appealing by raising pay and increasing performance bonuses. But more opportunity is even more important. “Show current employees you value them even more than potential new hires by providing them with new opportunities to grow and advance,” according to Six Strategies to Boost Retention Through the Great Resignation. “Workers are hungry for this vote of confidence.” Further, organizations that prioritize purpose are more likely to gain an upper hand. “Purpose is the timeless reason that your organization exists. It’s the reason people join and choose to stay.”

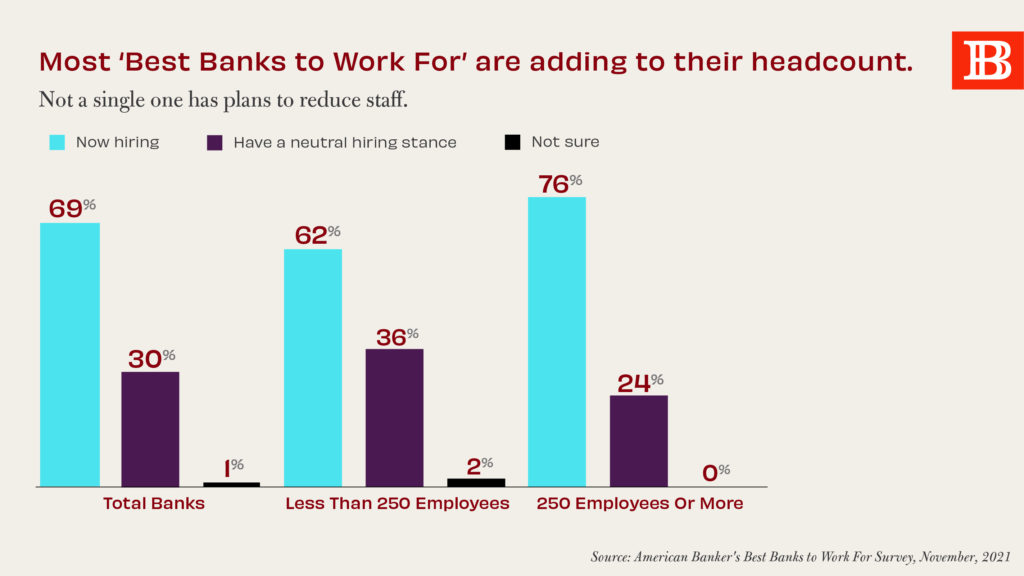

Already expanding their workforce before the pandemic, most of American Banker’s Best Banks to Work For report even more need for employees amid evolving staff roles. According to American Banker, HR executives say that “what worked to attract and keep employees in the past may not work in the years ahead.” With the rise of remote work, employee expectations rule. “Banks are grappling with an unusually competitive labor market leading to higher wages and giving many prospective hires the leverage to demand a continuation of the remote-work.”

Mike Lantz, chief people officer at Quontic Bank in New York puts it this way: “People are looking for companies that align with how they want to live their lives, he said. But it’s not just about letting people work from home.” Rather than filling the same positions with the same candidates, smart banks and credit unions are using this opportunity to create better jobs and better workplaces – where culture and purpose meet. That includes evolving how to attract the most diverse candidates and opportunities to influence your organization’s culture.

“Despite the instinct and pressure you might feel to move quickly and fill gaps, your diversity recruiting efforts actually depend on slowing down and taking a strategic, long-term approach,” according to HBR’s The Great Resignation Doesn’t Have to Threaten DE&I Efforts. Doubling down on diversity rather than easing up is what’s called for in this moment. Diverse staff will strengthen your financial institution for the future, a fact not lost on Visa as it expands into Atlanta and Bank of America as it diversifies staff in low- and moderate-income communities.

For the latest data, news and trends in financial services, stay tuned to Believe in Banking. For insights on building diverse culture programs that empower and engage, contact Adrenaline’s banking and credit union experts at info@adrenalinex.com.