The Story:

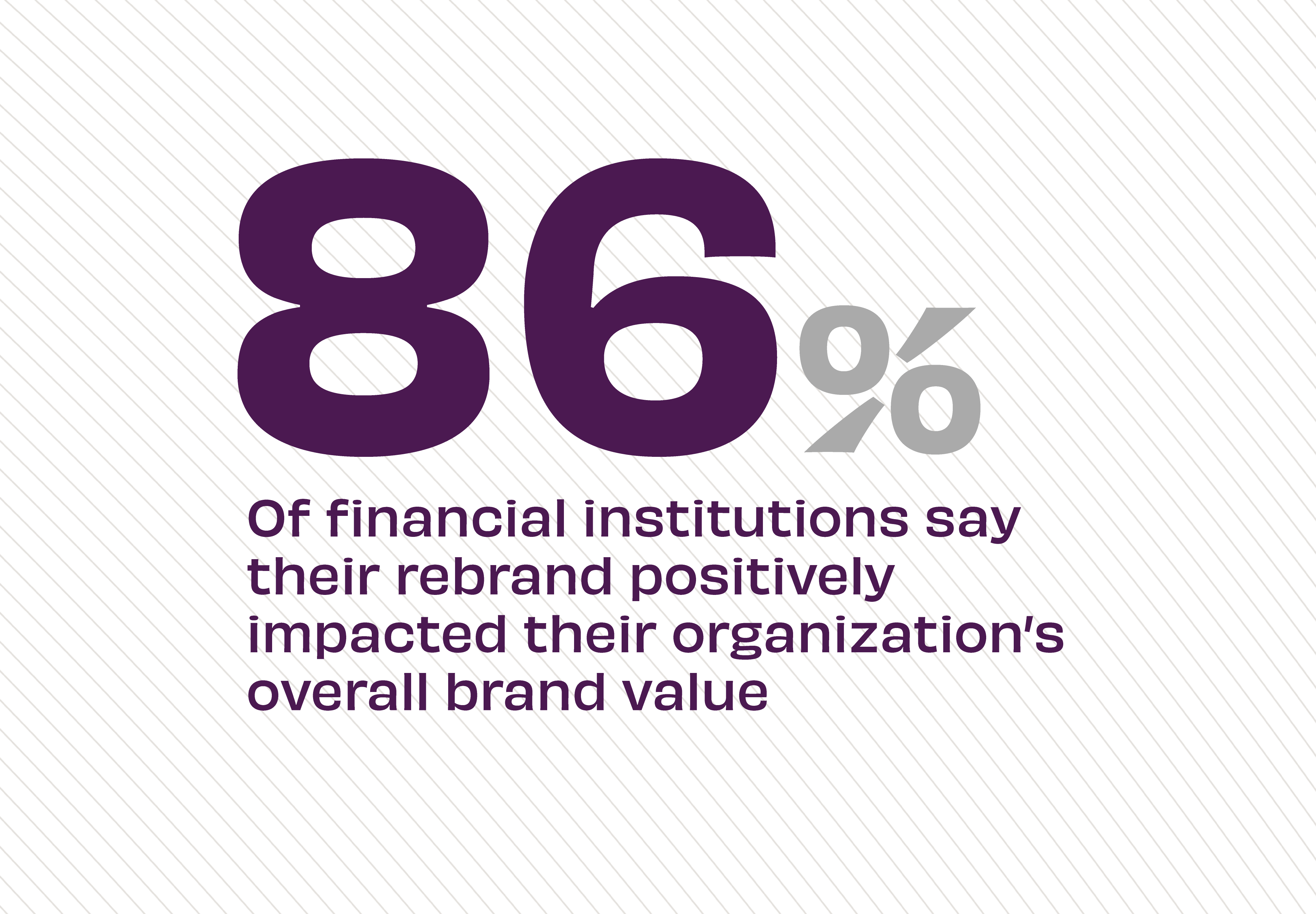

The need for brand differentiation is one of the core challenges all companies face, and something that’s especially true for financial brands awash in a sea of sameness. But banks and credit unions that invest in their brands reap big rewards, according to new data in Adrenaline’s ROI of Rebranding report. A survey of financial institutions finds that nearly nine-tenths of them report greater brand value to their organizations following their rebrand efforts. Even more, banks and credit unions rank improved company culture, customer/member growth, and business growth as the top-three areas most impacted by rebranding.

The Takeaway:

The report also features an analysis of financial institution clients who underwent rebrands and found bottom line benefits, with rebranded banks realizing a 13.6% increase in compound annual growth rate (CAGR), compared to 7.4%, the U.S. industry average. “The conversation has changed,” says Juliet D’Ambrosio, Chief Experience Officer of Adrenaline on the Believe in Banking Podcast. “I’ve been at Adrenaline for five years having these kind of conversations with banking leaders and there is a macro story to be told around the business advantage of brand that five years ago was not widely understood. Today, there is a sea change in this industry in which the business advantage a brand [has]… everyone now understands it.”

Source: Adrenaline, “ROI of Rebranding: Best Practices to Measure Business Value for Financial Brands,” May, 2024