We believe that better banking creates stronger communities and a better world.

One out of four banking leaders expect to merge within the year as deal values climb Despite inconsistent predictions and a...

In Part 2 of their special guest episode of the Believe in Banking podcast, Gina and Juliet welcome back Yvonne Garand,...

More than 700 banks participate in the annual “Teach Children to Save Day” to deliver financial education to more than 7,000...

Monthly Round-Up

Sharing Successes

Bankers from across the country are heading back to the classroom on Thursday, April 24, 2025, to participate in Teach Children to Save Day. This annual event supports student learning about managing money – setting financial goals, saving money and spending responsibly. “This free, banker-led personal finance program is complete with engaging activities that encourage children to develop a saving habit early in life, according to the American Bankers Association. “Used by teachers and community organizations across the country, this presentation – given by a real-world expert – will teach children sound money skills that will last a lifetime.”

More than 700 financial institutions participated in last year’s program, featuring national banking brands like Bank of America and Citi, and regional and community banks like First Horizon and United Bank. Tailored for grades K-8, Teach Children to Save is held during Financial Literacy Month and is ideal for elementary and middle schools, after school programs, and parent teacher associations.

Read more about banks participating in this year’s Teach Children to Save Day.

Data You Can Use

Of customers have been with their primary bank for more than seven years

The Story:

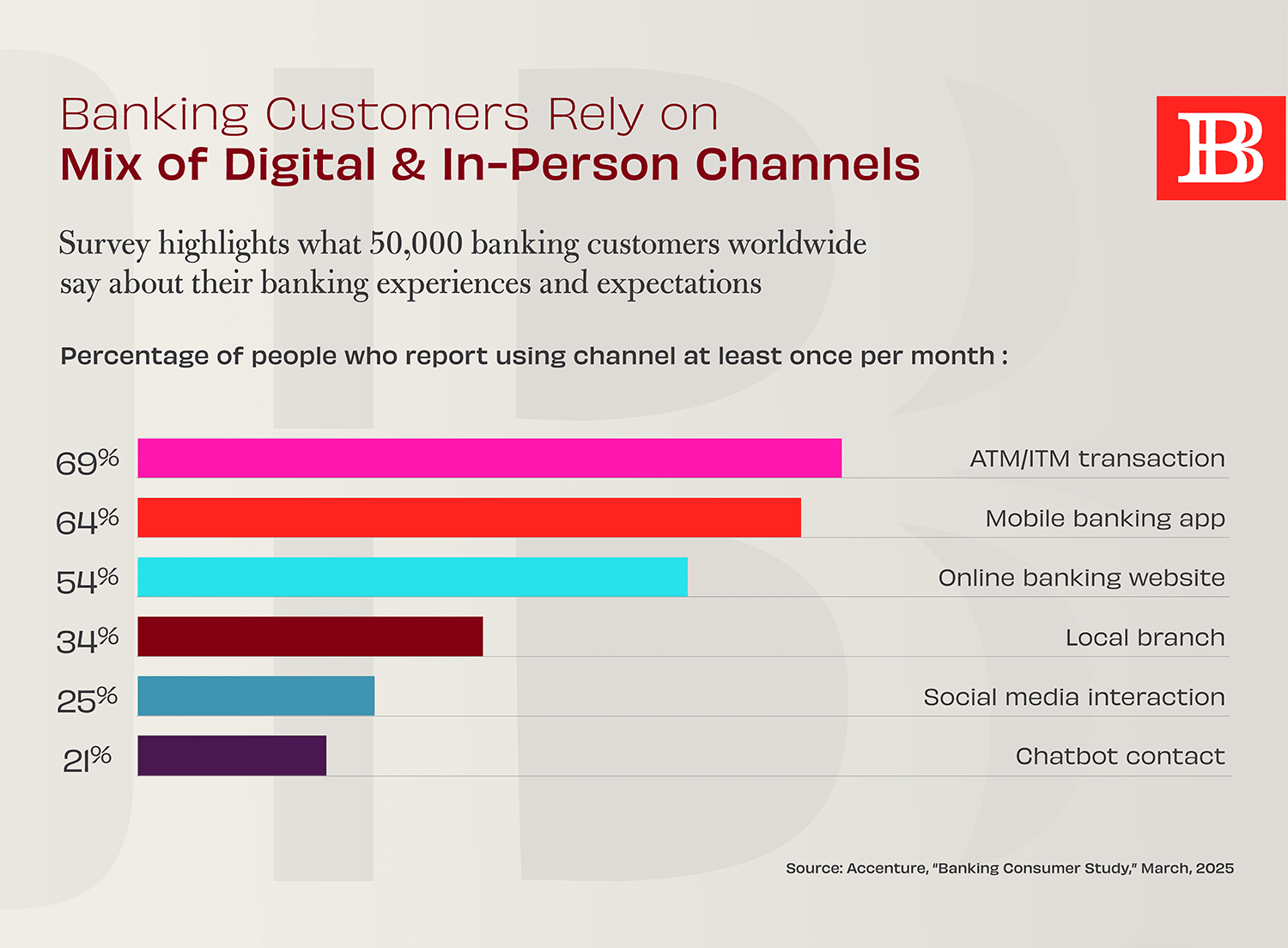

In an era of diversifying financial relationships, new data from Accenture finds that more than 6 in 10 customers have been with their primary bank or credit union for more than seven years. While people report a relationship with a primary financial institution as their main source of financial services, 73% of customers say they also do some banking with a competing financial services provider – averaging two bank accounts and two digital wallets per person. With this level of financial diversification, what can banks or credit unions to do deepen their existing relationships with current customers or members?

The Takeaway:

Accenture says long term banking relationships lean on “lazy loyalty,” where a customer has a banking relationship but doesn’t actively endorse or promote the bank to others. “What’s missing is advocacy,” according to the Forbes article, How Banks Can Replace Lazy Loyalty With Customer Advocacy. “Where enthusiastic customers believe their bank is working hard for their financial security and aren’t shy to tell others about it.” Forbes outlines four main drivers of customer advocacy – 1) trust and transparency 2) personalization and tailored advice 3) customer satisfaction and experience and 4) benefits and rewards. “Building customer advocacy is not the only a way to reignite the spark between customers and their banks, but it’s a crucial strategy for profitable growth.”

Sources: Accenture, “Banking Consumer Study,” March, 2025, and Forbes, “How Banks Can Replace Lazy Loyalty With Customer Advocacy,” March, 2025

Stay Tuned

Listen in to the Believe in Banking podcast, our award-winning monthly series for decision-makers, influencers, and industry leaders. The podcast explores what’s on banking’s radar through compelling conversations with hosts Gina Bleedorn and Juliet D’Ambrosio.

Stay Engaged

Follow us to keep up with the latest content from Believe in Banking and Adrenaline. We’ll help you stay informed with the latest banking industry trends, data you can use, actionable insights, expert thought leadership, new podcast episodes, and so much more.