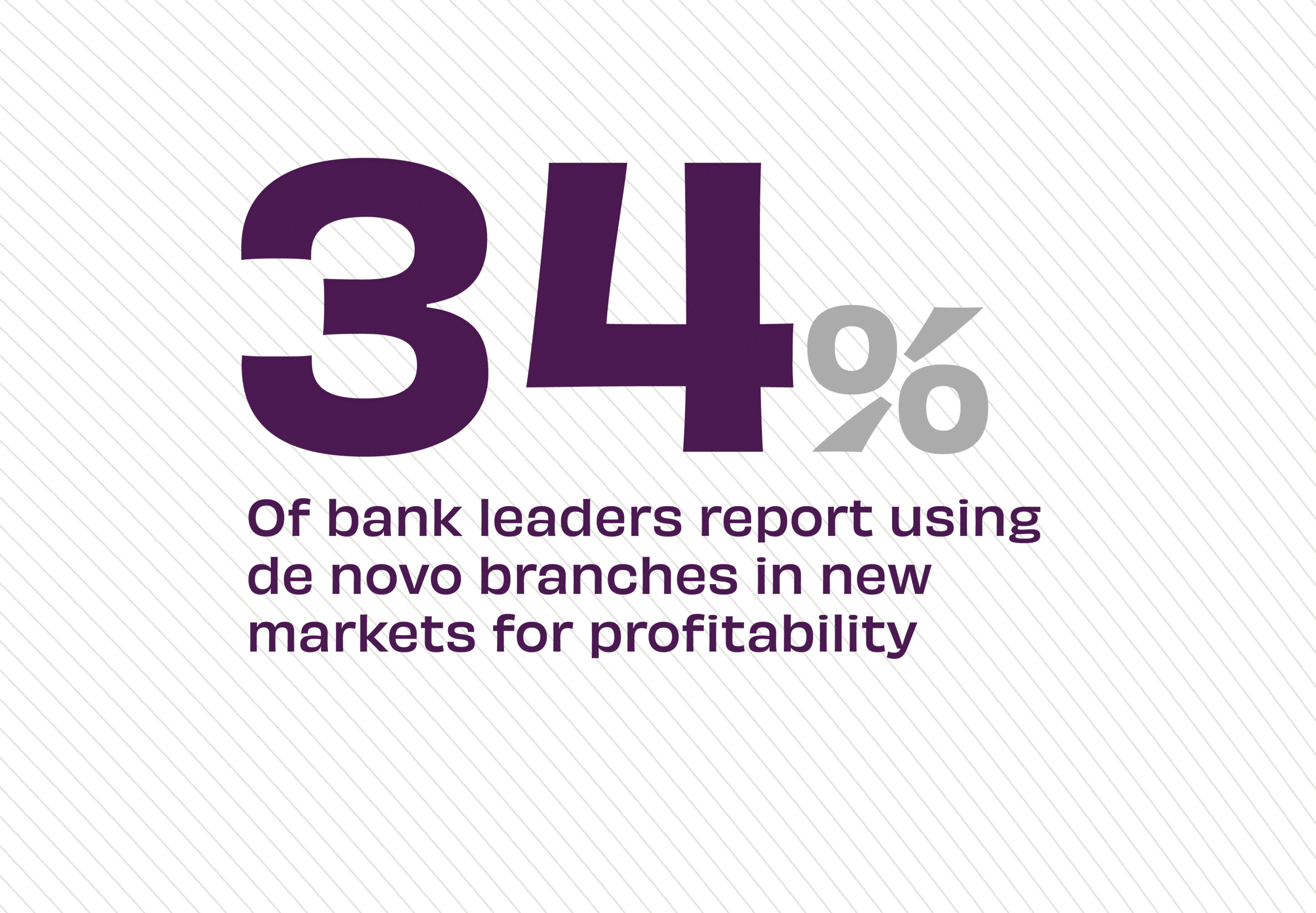

The Story:

New data on financial success in banking from Bank Director finds that more than one out of three banking executives report that their institution currently deploys de novo branches as a central part of their path to profitability. That’s a smart strategy for banks looking at attracting first-time customers. According to the latest Federal Reserve data, de novo branches “grow faster and to a larger scale” than new branches of banks with an established presence in the market. Despite these findings, the Fed says, “The success of a new bank branch is not guaranteed,” and finds big banks still have a scale advantage over smaller rivals, even when both enter the market at the same time.

The Takeaway:

Key to new branch success is the right staffing. The Bank Director survey also found that 63% of banks are adding staff in revenue-generating areas of the bank, like the branch. “De novo branches can no longer be expected to capture their fair share of local deposits over time simply by being there,” says Adrew Hovet, managing director of Curinos. “To make de novo branches or market entry successful, banks need to pull several investment levers,” including branch marketing and merchandising, staffing with a “specialty salesforce” ready to consult and cross-sell, and deploying ATMs/ITMs to serve as dot connectors along the branch network.

Source: Bank Director, “2025 Bank Outlook Survey,” November, 2024; The Federal Reserve, “Size and Survival of Entrants to Retail Banking,” September, 2023; and Curinos Perspective, “What Other Banks Can Learn From Chase’s Branch Expansion,” February, 2024