How banking for good is rebuilding trust and expanding options for underbanked communities

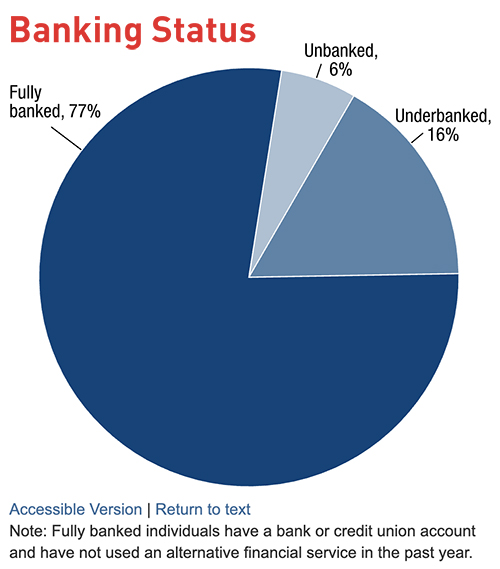

According to data gathered by the Federal Reserve pre-pandemic, there are at least 22% of American adults – 63 million people – who are unbanked or underbanked in the United States. That’s more than 1/5 of American adults who rely on some form of “alternative” financial products or services like payday or pawn shop loans, check cashing services and money orders for managing their routine finances. Often with large fees, collateral and contingencies, these nontraditional financial services do not offer the safety or stability of a bank or credit union account.

Further, for underbanked communities there is a steep cost associated with having no primary financial relationship. According to Forbes, underbanked consumers carry an average of “$3,000 in annual costs per person” in fees on alternative services and critically, have little to no access to credit, lending, savings or time-saving and money management tools. Certainly, there has been a move toward investing in initiatives focused on diversifying banking, including lending for women, black and veteran owned small businesses and banks like Greenwood with digital banking for black and Latinx customers, yet, the rate of underbanked has continued to consistently rise, no doubt exacerbated by the pandemic.

Much like food deserts, diverse communities of color have a much greater chance of having no primary financial institutions within their neighborhoods and even if they do, longtime practices like redlining have sowed distrust, limiting consumer financial options and long-term economic outcomes. According to McKinsey in their report on financial inclusion: “Black families have faced the compounding effects of decades of exclusionary policies and programs” with impacts from “federal mortgage lending to geographic barriers to physical bank branches” that have “hindered black economic well-being” and “contributed to the racial wealth gap.” But there is positive movement on the horizon in the form of increased investment and increased demand.

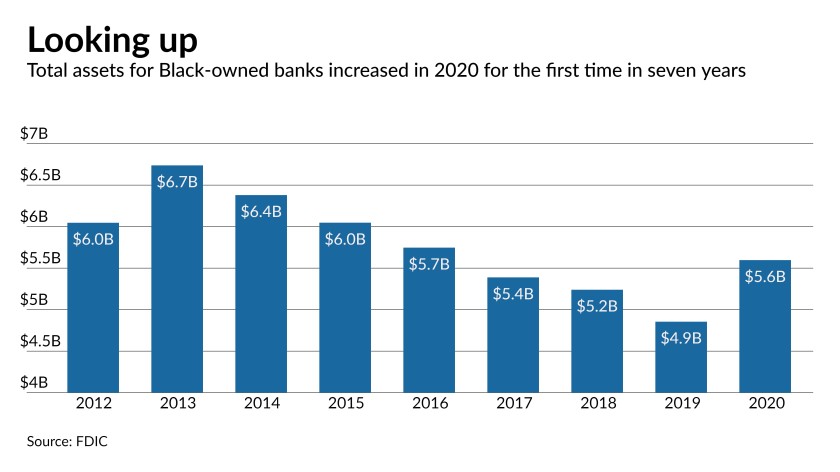

So, how are banks restoring the trusting relationship and building bonds in underbanked communities? Banking for good; and the good news is that big banks are following through on their promise to do more and do better following the Black Lives Matter (BLM) protests and consumer demand for purpose-driven brands. What needs to happen next is, though, is that these efforts must be accelerated and engrained in the way financial institutions do business and grow their influence. While having big banks understand the underbanked is a move in the right direction, the most meaningful change is happening from within. Ultimately, more competition means more services for more communities or as American Banker says, “[M]ore capital and increased revenue should make banks more competitive when it comes to serving members of their community.”