The Story:

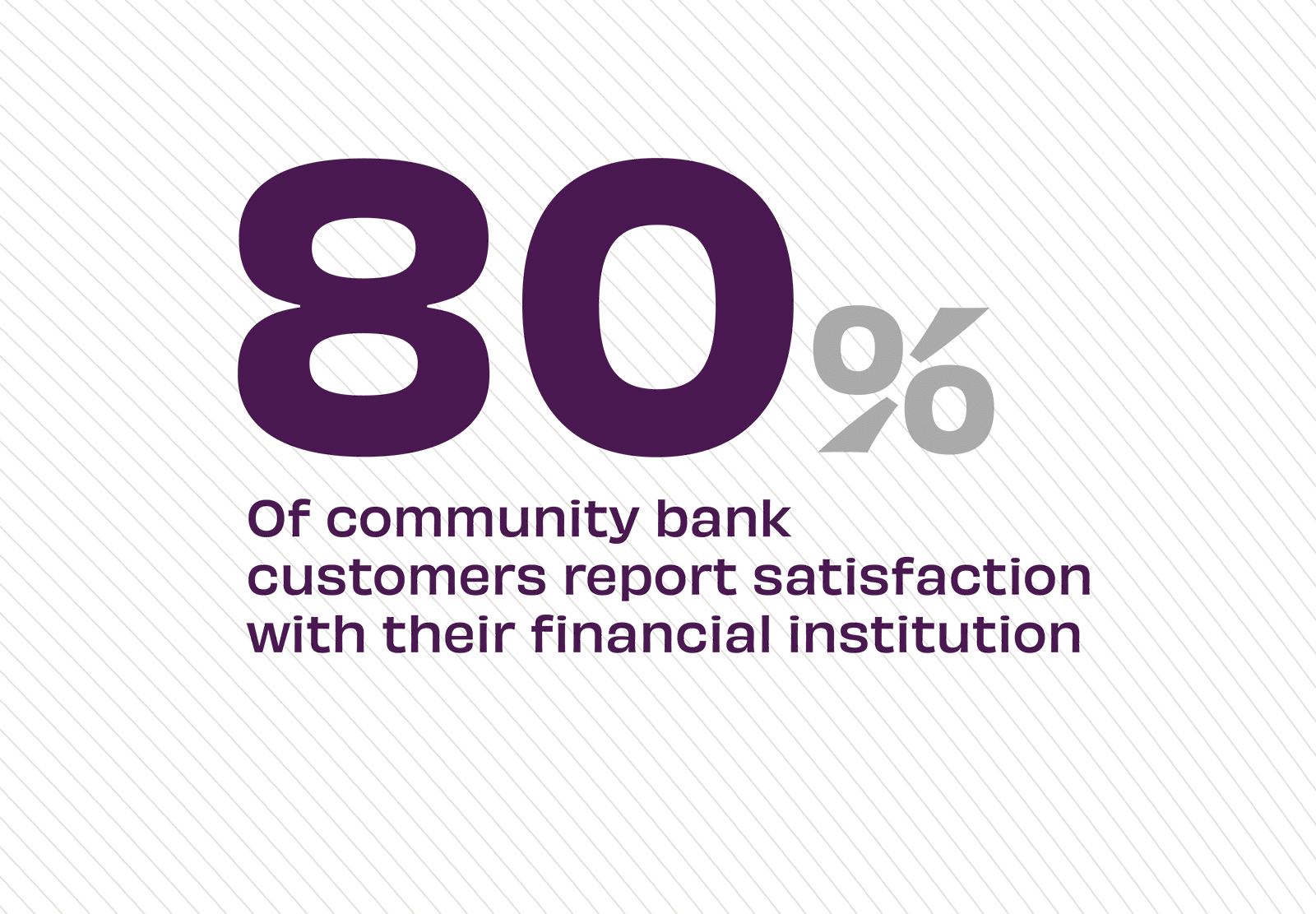

Not only do community banks engage in community development at greater rates than national banks, they consistently generate higher customer satisfaction scores than big banks, according to the American Customer Satisfaction Index for 2024. The annual survey on banking satisfaction finds that community banks scored 80 out of 100, whereas national banks ranked six points lower at 74 out of 100. With small business customers, the satisfaction gap grows even wider. The Small Business Credit Survey finds that net satisfaction for business owners holding accounts with community banks is at 74%, besting larger national banks by a whopping 21 percentage points.

The Takeaway:

One major factor contributing to such high satisfaction rates is the connection customers feel with their community banks. “Community banks pride themselves on personalized service,” according to the 2024 BNY Voice of Community Banks Survey. “To keep pace with changing times, many have been upgrading their technological capabilities to offer online banking, automated loan decision-making, and other cutting-edge services.” These upgrades allow community banks to compete head-to-head with big banks. Even more, customers trust community banks to provide tailored solutions that meet their financial needs today and for the long term.

Source: American Customer Satisfaction Index, “Customer Satisfaction in Community Banks,” October, 2024, Fed Small Business, “Small Business Credit Survey,” March, 2024, and BNY, “The Voice of Community Banks Survey,” September, 2024