Considerations and consequences for merging brands in the financial services sector

In our last feature on Integrating Brands Following M&A, we addressed early considerations for internal alignment and the external expression of two entities following a merger or acquisition. Determining a smart structure is first on the docket, with brand architecture defining how the two brands will relate to each other. Next comes decisions surrounding the timing and tempo of the new brand unveiling defining introduction to audiences both inside and outside the institution. Make no mistake, these decisions have material consequences. Following the 2019 SunTrust and BB&T merger, the new Truist brand is now the sixth-largest commercial bank in the country and positively positioned for a continual scale.

How the two brands relate post-merger is critical to future success. As Money Marriage highlights: “While it makes sense why banks would want to merge, how they do it makes all the difference for their success. Making a smooth transition from brand communications and retail experience standpoint determines the success of the merger.” Further, understanding the strengths each brand brings to the table pre-merger can help shine the path forward post-merger. In the case of Truist and others, an entirely new brand has its own set of distinct challenges ahead. As these examples bear out, a strategy is not a one-and-done exercise. Continual brand alignment is critical for M&A success.

Phasing In

When brands unify under a singular umbrella – whether it’s under a new moniker or the acquirer’s brand – they must align all of the internal and external brand elements and assets, from the brand through to the branch. The merger between Wachovia and Wells Fargo in 2008 is an example of aligning Wachovia assets under the Wells Fargo umbrella in a planned, phased approach. Typically, the digital assets are converted first, as they are easier than the physical touchpoints. Brand communications are then rolled out, laddering with signage and in-branch conversion. In the case of Wachovia, the transition took more than 36 months to completely convert to Wells Fargo across the country.

Strategic Combination

Another model for bringing brands together is through strategic combination – unifying and leveraging the most recognizable, weightiest, and/or highest-equity elements of each legacy brand into an orchestrated, meaningful and updated whole. With this strategy, some distinct elements of each of the merged brands are embraced and amplified. The primary reasoning behind this approach is to create a brand that feels both recognizable to legacy customers, yet fresh to new customers and the market. It’s the best of both worlds but requires assessing the strength of each asset’s positioning and deployment.

A good example of the combined approach is the marriage of Ameris and Fidelity, in which the recognizable Fidelity Lion icon fused with the Ameris brand name combine for a familiar yet new visual identity. A new color palette and brand patterns and elements, along with a new tone-of-voice across messaging and communications helped create this new brand. On the merger, Ameris says, “The culture and banking philosophies of Ameris Bank and Fidelity Bank are in sync – we are like-minded community banks with similar core values, a passion for excellent customer service and a belief in the power of our communities.” This approach keeps the best of both brands while ushering in a new chapter.

In some cases of distinct audiences and geographies, occasionally two brands can co-exist through an endorsed model. But as Gina Bleedorn, CXO at Adrenaline, outlines in Brand Architecture: A Defining Feature for Growth, “Most banks and credit unions use statewide service as their benchmark for scale. That’s because that’s the size that consumers are looking for in a bank. If you answered yes to the key questions [about the audiences you serve], your financial institution might be a candidate for successfully operating under either an Endorsed Brands or a Sub-Brands model, but you’d need a strong strategic case because of the operational inefficiencies involved with multiple brands.”

Meeting of Equals

In some cases – a merger of equals – for example, it’s critical to create a new entity that delivers on a related but different promise from their legacy brand roots. TRUIST is a good example of a true merger of equals between BB&T and SunTrust, who came together to create a new brand, a new name, and identity, along with a new purpose and promise, pulling the legacy of the founding brands into an entirely new experience. In this case, the name arose from the shared trust of both brands, making it their own with a slight change. With a distinctive color palette and a digital-ready logo, Truist can now focus on storytelling for their brand “to give it some personality” and a thoughtfully crafted tone-of-voice to provide a distinct identity for the new brand.

Culture as Cohesion

Underpinning all brand considerations is the culture of the two organizations. This far exceeds the way a brand looks and focuses on the way a brand is lived. Whether the merger requires reaffirmation or reintroduction, the linchpin of successful mergers is largely cultural and it begins with employees. For merging entities, it’s critical to create a shared employee experience around common vision and values. Merging brands must assess the culture of each entity and combine core elements into a cohesive whole with clear direction on values and behaviors. Training that supports this cultural shift can empower employees in bringing the new brand to life and help them feel part of the process of the change.

Built from the Inside

With internal audiences in mind as a first place to build equity and advocacy, a thoughtful launch strategy focusing on leveraging the internal strength of employees must come first. Laddering and layering efforts following the internal launch, additional efforts bring all those audiences along and bring values to life, while building excitement for the brand – from the inside out.

A successful launch strategy includes:

- Employee Launch – Building a clear understanding of, sense of ownership for, and internal advocacy for the brand. The employee launch should be supported and sustained with training and learning around new cultural standards and actions.

- Member/Customer Launch – Audience efforts should seek first to answer pressing questions and present the new brand in terms of what the change means to the customer or member. A well-crafted FAQ, a special landing page, and a clear communications plan that ideally underscores the benefits of the merged through from their point-of-view is foundational to success.

- Market launch – External efforts should aim to build awareness for the new or repositioned identity to build excitement around the expanded offerings and promise of an institution. This launch should highlight the brand’s newly achieved combined strength to serve people – more and better.

Communications Standards

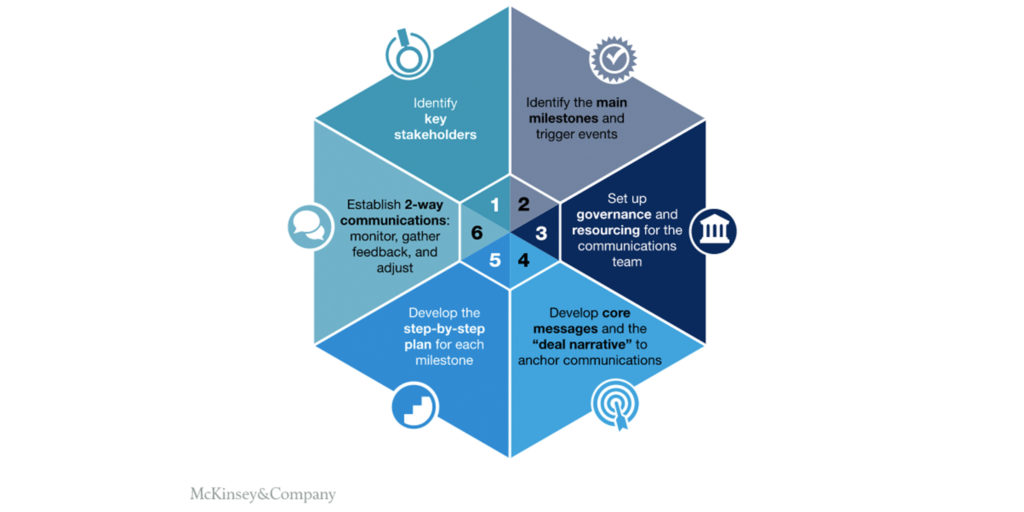

Creating meaningful communications both internally and externally is central to a successful M&A approach. McKinsey recommends a six-step process to consistently implement and improve merger communications, saying, “These steps aren’t meant to be “one and done.” They are usually iterative and often require refining as the communications and leadership teams learn lessons during the phases of the merger and get feedback on the initial communications – and as communications needs evolve.” Identifying stakeholders is the first step in the process for a reason. “Employees are critically important stakeholders. They must be excited about the new company’s vision and buy into it. Before they can get there, however, they need to understand what will happen to them.”

Customer-centric communications around M&A brands are critical to ensuring adoption of the new brand by employees, current customers or members, the market, and the industry as a whole. According to McKinsey, “A strong communications strategy and plan promote business continuity by ensuring that the right messages are communicated and reinforced to minimize the anxiety of employees, boost morale, and retain talent.” This enterprise-wide communications strategy links to an overall launch strategy and considers every channel, from the physical branch to social to digital/mobile experiences to advertising to basics like bank statements, ensuring every touchpoint is calibrated and aligned.

In an upcoming feature on Believe in Banking, we will explore the concept of customer-centricity in banking and how it comes to life from your brand to your branch. To begin developing M&A strategies in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903. For more information on bank branch reopening in the post-COVID landscape, download the Roadmap to Reopening. If you need support for staffing, see the Frontline Staff Engagement Training series.

Header image: Douglas Kilpatrick / The Morning Call file photo