As Twitter (now “X”) continues its changes and Threads comes to market, social media is back on the front burner for all brands. For financial brands in particular, social media not only provides an effective platform for connecting with consumers, but represents a way to reduce reputational risk as well, particularly after this spring’s regional banking challenges. “Any bank that doesn’t pay attention to their social media presence, and the effect it might have on deposit behavior, is doing themselves, their stakeholders and most importantly, their depositors, a pretty significant disservice,” says Greg Hertrich, head of U.S. depository strategies at global financial services company Nomura in an interview with Reuters.

Using their channels’ immediacy and engagement to their advantage, many financial brands leveraged their social media platforms to quickly connect with customers and proactively provide facts and resources. “Even if most banks and credit unions understand the importance of branding, they may not know that the way a brand shows up in the world speaks to their lived values,“ says Adrenaline’s Chief Brand Officer Juliet D’Ambrosio in her Financial Brand article on how branding pays off for bank brands. “Tapping into those values can provide a way forward during turbulent times.” How better than social media to demonstrate those brand values?

Beyond mere marketing messages, social media represents a way for bank brands to directly communicate with consumers, and what they convey gets noticed. Take, for example, the tale of two Citizens, as outlined in the Financial Brand. Following the regional banking failures, Citizens – the 14th-largest bank in the country – used social media to show up “ready to serve our customers and communities.” In the wake of banking turbulence, their post directed customers to resources and information about how Citizens is protecting consumers. Known for their deft use of Instagram, in particular, Citizens uses social to influence and inform.

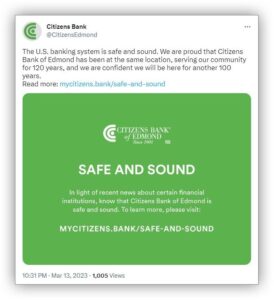

The other Citizens – Citizens Bank of Edmond, a community bank in Oklahoma – is also widely known for their social savvy. Following the failure of SVB, the community bank’s multichannel messaging was found on their owned and social platforms. Their CEO Jill Castilla provided customized channels where customers could get answers to “any questions or concerns you may have about this environment” and provided assurances that Citizens is “safe and sound.” Like VeraBank, another community bank responding quickly and effectively, Castilla also went beyond social posting, providing her personal cell phone to directly field questions and concerns from customers.

If you’re a banking leader looking for strategies customized to your financial institution, get in touch with Adrenaline’s banking and credit union experts. And, don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.