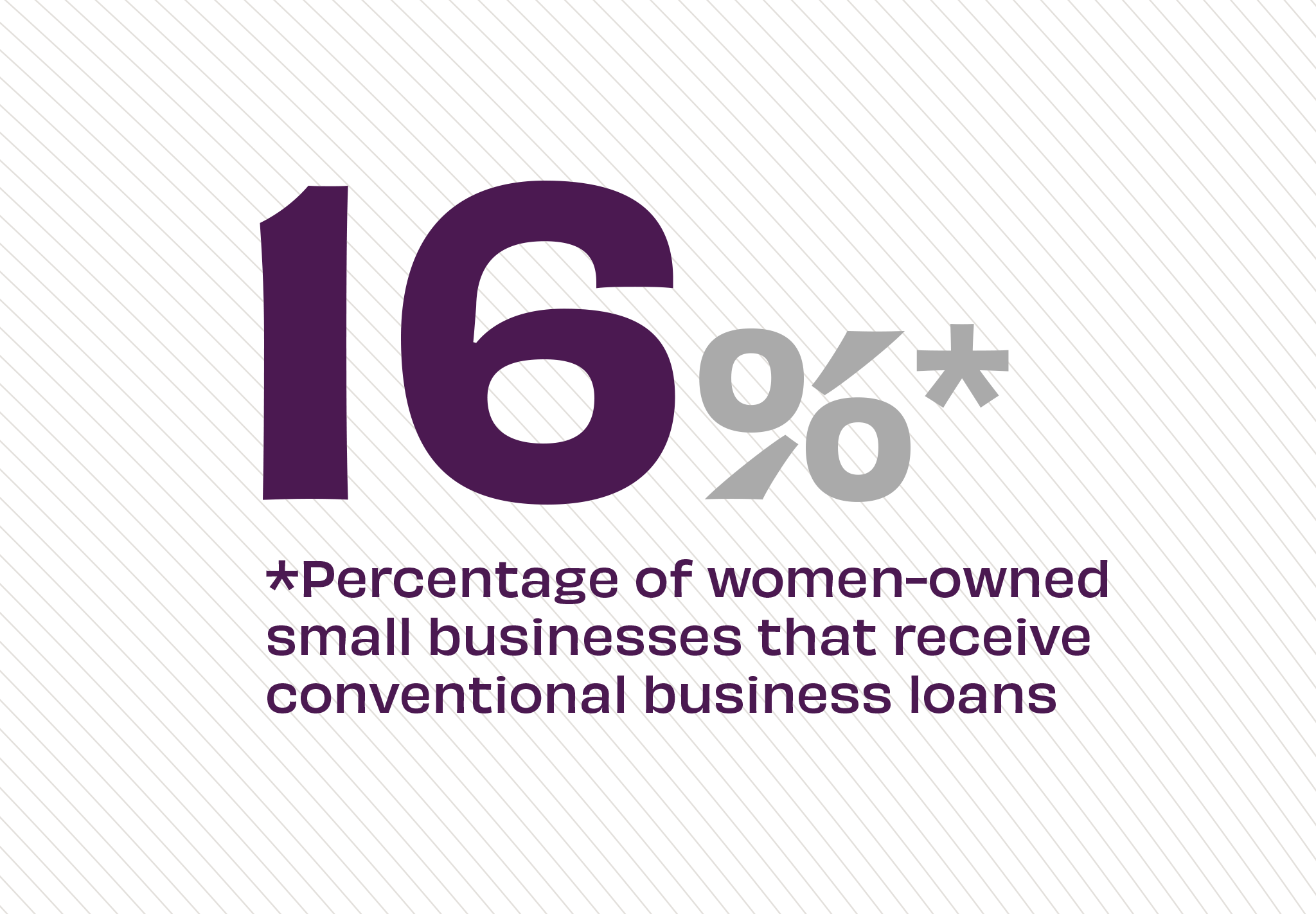

The Story: Nearly four out of ten small businesses in the U.S. are owned by women. However, data shows that only 25% of women versus 34% of men are likely to pursue business lending through banks or credit unions. Experts point to several reasons for this disparity, namely that women believe their businesses are less likely to receive start-up capital. Further, these entrepreneurs believe they lack the requisite track record to receive funding or simply don’t know how to apply. As a result, women often turn to personal forms of funding – like credit cards and home equity loans – to back their businesses.

The Takeaway: With the number of small businesses on the rise, FIs have an opportunity to grow their customer base by using marketing campaigns for their lending products and services targeted toward women-owned businesses. In order to inspire local entrepreneurs to apply, bank marketing should plant seeds in prospects’ minds by transparently demonstrating qualification criteria used to make lending decisions and highlighting examples of successful partnerships between banks and businesses.

Source: Independent Banker, “First Women’s Bank Tackles Small Business Inequity” March, 2022