Products and services that meet people’s needs are driving innovation and delivering value

With the pandemic impacts waning and competition from all quarters, financial services are at a crossroads. Accenture puts it this way: “Is banking about to have its electric car moment?” meaning that the industry is at a tipping point of disruption that can either embrace a new way of doing business or stay rooted in legacy thinking and doing. “The transition from gasoline cars to electric cars is a compelling illustration of how quickly business models in a well-established industry can crumble in the face of new technologies and customer expectations,” according to the consultancy’s recent report on purpose. While daunting, there is real growth taking on the challenge of change.

“Financial services companies have a unique opportunity to address major societal issues, while also nurturing new markets and generating profit,” says Monica O’Reilly, vice chair at Deloitte in her recent BankThink article. “Companies can – and should – aspire to this, as it is an opportunity to not only benefit shareholders but also to collaborate with other key stakeholders.” In our coverage on how banking can live the power of purpose, we discussed the principles underpinning a purpose mindset. More than cultural and societal, there are demonstrable business opportunities that come from purpose. O’Reilly says, “We call it a ‘higher bottom line’ of human-centered capitalism.”

Looking across the financial services industry, there are some new approaches to banking – from products to processes – that seem poised to change how the industry delivers its services and propel people’s financial lives forward at the same time. With banking services that meet people where they are, these advances drive change for the industry and bring greater value to people’s financial lives.

1. PNC’s Low Cash Mode

Helping consumers avoid overdraft fees, PNC’s new feature in its digital banking platform lets customers set up notifications to foster financial decision-making. The company says, “Low Cash Mode delivers real-time intelligent alerts that let you know when your balance is low, allows you to choose whether certain transactions should be paid or returned when your balance is negative and gives you at least 24 hours to bring your account out of the negative so you can avoid overdraft fees.” Part of its virtual wallet suite, these digital tools help consumers stay in the know and stay on track with their finances. Given that 51% of consumers are focused on financial wellness in 2021, this service is right on time.

2. TD Bank’s Essential Banking

This new low-fee, no minimum balance deposit account was created to meet the needs of the underbanked and unbanked. TD’s proprietary research found that “37% of unbanked customers cite fee avoidance and lack of funds as the top reasons discouraging them from opening a bank account.” Answering the call, TD created this flat-rate monthly account that provides overdraft protection, no-fee ATM access, simple savings into an interest-bearing account and rate discounts on lending products. The company says, “TD’s goal for this new account offering is to help our customers establish a more secure, inclusive and sustainable financial future for themselves, their families and their communities.”

3. Walmart’s MoneyCard Becomes a Checking Account

A brand built on consumer value, Walmart has entered the ranks of banks with a new deposit account embedded in its MoneyCard. What was simply a leading payment method, the prepaid debit card will now include enhanced banking features including overdraft protection, direct deposit and interest on savings. Through a partnership with Green Dot, Walmart’s expanded services empower consumers to “access, manage and move their money – and ultimately improve their financial health – through a suite of innovative and useful tools that will evolve and expand over time.” Positioning itself as a fintech, Green Dot says it’s “committed to seamlessly connecting people to their money.”

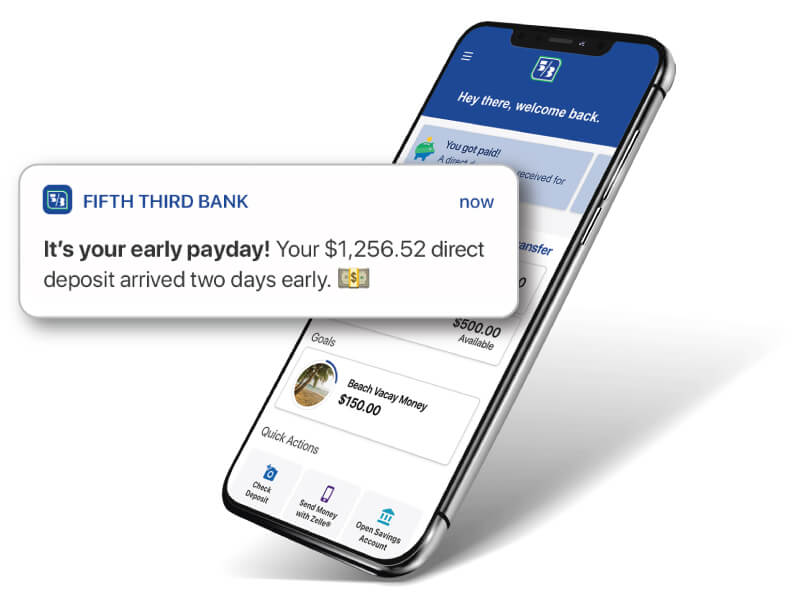

4. Fifth Third Bank Launches Early Pay

Taking a cue from fintechs, Fifth Third Bank has announced that it’s offering customers access to early paychecks in its Momentum Checking accounts. With “Early Pay” the new free feature allows customers access to their paychecks up to two days early. This product “gives our customers access to their paycheck closer to when they earn it, giving them more time to focus more on their financial well-being,” according to Tim Spence, president of Fifth Third Bancorp. This flexibility is focused on “giving customers the widest range of options to access their money faster and avoid fees.” This move away from a fee-driven and toward a consumer value model is an example of how banking can broaden its base.

5. Big Banks Bet Big on Lending

Some of the nation’s largest FIs are looking at the lending landscape as a way to grow their prospects and expand consumer credit and financial options. Part of a government-backed initiative to extend credit to people who have traditionally been locked out of lending, JPMorgan Chase, Wells Fargo, U.S. Bancorp and others will now coordinate their efforts and “factor in information from applicants’ checking or savings accounts at other financial institutions to increase their chances of being approved for credit cards,” according to the Wall Street Journal. Aimed at individuals without credit scores but who are financially responsible, the pilot program expected to launch later this year will expand credit as consumers are optimistic and ready to spend.

It’s not just the big banks ready to meet the moment. Community banks and credit unions are leveraging the infrastructure and technology they developed during the pandemic to take on new opportunities – to spur small-business lending with the same efficiency and convenience they had in the PPP process. As evidenced by these new offerings, growing banking products “comes from focused – not wide-ranging – feature offerings that solve a specific problem exceptionally well,” according to Tearsheet. With an “accelerating economic recovery is likely to boost bank profits,” the Wall Street Journal says banks are perfectly positioned to roll out new products that meet post-pandemic consumer demands.

For more insights on purpose-driven, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop meaningful experiences for customers and members, especially post-COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.