The Story:

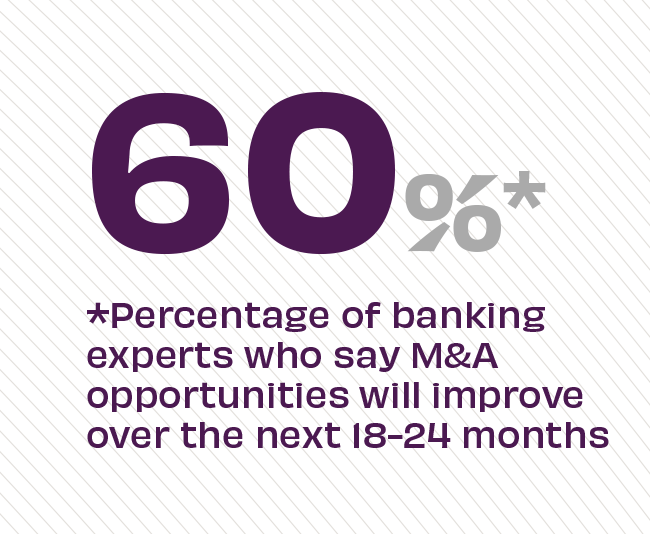

Mergers and acquisitions saw a slowdown in 2022, amid recessionary fears and concern over increased regulatory scrutiny of would-be dealmakers. But now, notable finalized deals at the start of 2023, improving economic conditions, the need for efficiency for smaller community institutions, and new partnership prospects are providing a better climate for M&A. Even more, with fintechs losing valuation – 60% between Dec ’21 and Aug ’22 – and needed investment capital, the time for fintechs to merge with banks is nigh. In fact, 75% of corporate development experts predict banks will merge or acquire more fintechs over the next two years.

The Takeaway:

As financial institutions continually prioritize growth, mergers and acquisitions provide new opportunities in new markets, but due diligence ahead of any proposed merger is essential. For banking M&A to be successful, merging companies must consider how to culturally align two merging brands and develop a holistic program that includes branding and naming approaches tied to growth. Further, focusing on a total experience post-merger will help brands deliver on an ideal balance of digital and physical channels for customers and prospects, alike.

Source: McKinsey, “Strategic M&A In US Banking: Creating Value in Uncertain Times,” November, 2022