An industry snapshot of banking’s rising commitment to environmental and green initiatives

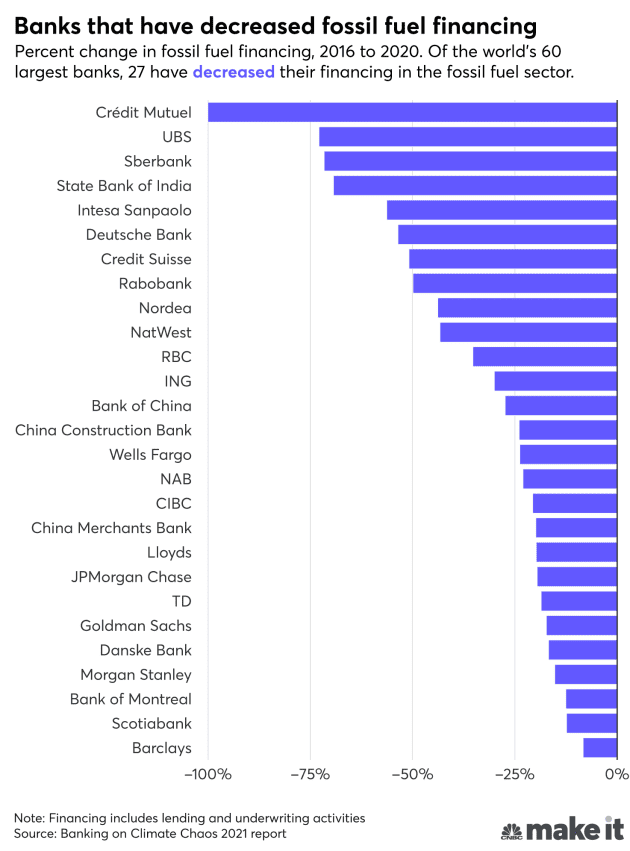

As part of a focus on Earth Day, financial institutions released a spate of environmental sustainability policies and perspectives in April. But how many of those policies will make it into practice, affecting how a bank operates? A CNBC report finds that despite a global focus on climate change, banking is still investing in oil and gas, saying, “The 60 largest commercial and investment banks have collectively financed $3.8 trillion in fossil fuel companies between 2016 and 2020, the five years since the Paris Agreement was signed.” Some big banks are still big into fossil fuels, but that’s changing.

“Getting lenders to choke off money to fossil fuel companies is the next needed move for the industry to address the material risks that the coal, oil and gas industry faces,” according to Leslie Samuelrich, president at investment advisory firm Green Century Capital Management in that same CNBC report. As consumer demand for environmental accountability continues to mount, many financial institutions are embracing environmental sustainability as part of their core values set, as they champion a more purpose-driven, values-led approach to doing business.

Christof Innig, global lead of sustainable banking at Accenture says, “[T]he banking sustainability imperative takes on new urgency” with environmental, social and governance (ESG) issues no longer relegated to annual reports and position papers, but lived in the real world of banking. “Banking leaders are currently placing a strong emphasis on the “E”, the environmental and climate risk component,” according to Innig. “Some of the largest global financial services institutions, such as HSBC and Santander, have pledged net zero emissions by 2050.” That takes focused commitment to achieve.

With the rise of organizations like the Environmental Bankers Association to support the industry and Green America’s Get a Better Bank program to connect consumers to local green FIs like community banks and credit unions, it’s clear that banking green is mainstream. It’s not just the right thing to do for the planet; going green is also big business. Greenbiz reports that JPMorgan Chase is reorganizing around sustainable finance; Citigroup built a sustainability and corporate transitions group; and “The largest U.S. investment banks – Bank of America, Citibank, Goldman Sachs, JPMorgan Chase, and Wells Fargo – have adopted net-zero financing pledges, both for their own operations and their investment portfolios.”

While the banking industry makes moves toward a green future, consumers are letting their dollars do the work, from banking and budgeting to spending and investing. According to Bankrate’s report about consumers taking an ‘every day is Earth Day’ approach to all of their finances: “Money talks, and that’s never been truer than with environmental causes. Americans concerned about the environment will find that there’s no financial step too small to make a difference. And if the impact is broad-based enough, experts say it can translate to real change.”