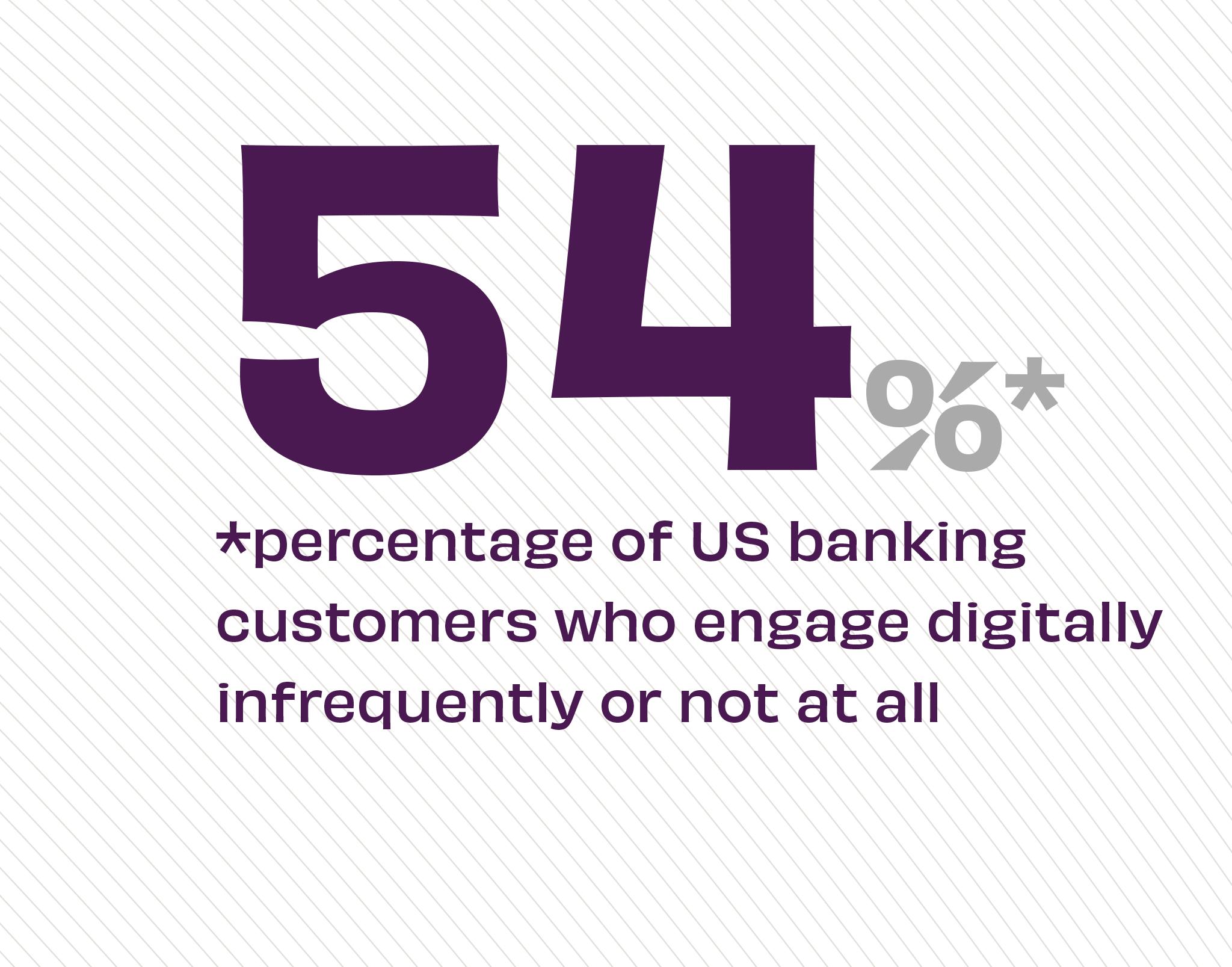

The Story: While the COVID crisis has accelerated digital adoption of online and mobile banking tools for consumers of all ages, more than half of people continue to rely on more traditional ways of making transactions – and report needing extra support to help make the transition to digital.

The Takeaway: It’s clear that banking brands must invest in digital channels to meet customer expectations and transactional needs. But other delivery channels – retail formats, drive-up, and ATM/ITMs, among them – continue to remain vital as we weather the pandemic and emerge from it. The key is providing interconnected options that are built around the full spectrum of customer needs.

Source: McKinsey Banking Journey Pulse Benchmark