The Story:

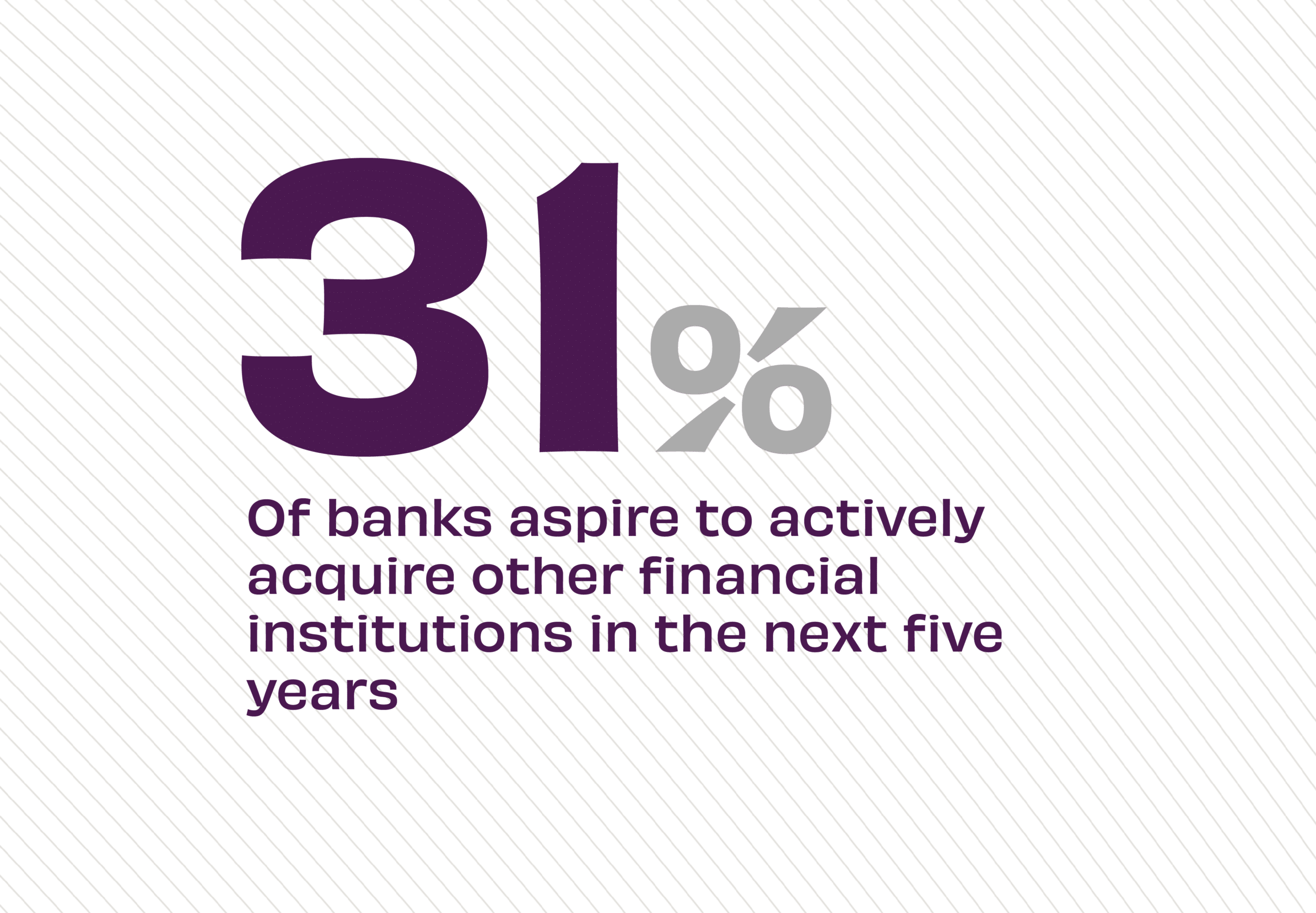

New data from Bank Director and Crowe finds that although bank merger activity has seen a slowdown over the past two years, banking M&A is expected to rebound in a big way in 2025 and going forward. When asked how they would characterize their financial institution’s growth strategy over the next five years, nearly one-third of senior bank executives and board members report they’d seek to become active acquirers, and an additional 52% say they’re open to acquisitions to grow their organizations. Only 17% of bank leaders say M&A is an unlikely path toward growth for their bank.

The Takeaway:

Up from 35% from last year, four out of ten executives say their organization is very or somewhat likely to buy another bank by the end of 2025. “The general sentiment in the industry is that M&A is back on the table,” according to Patrick Vernon, a strategy and transaction advisory senior manager at Crowe. “Some of those lower yielding assets have rolled off, and we’ve seen banks aggressively restructuring their balance sheets,” which puts them in a better position to purchase another institution. The survey also found that banks are engaging in organic growth activities, as well, including 63% adding staff to increase revenue generation and 34% expanding with new branches in new markets.

Source: Bank Director and Crowe, “2025 Bank M&A Survey,” November, 2024