The Story:

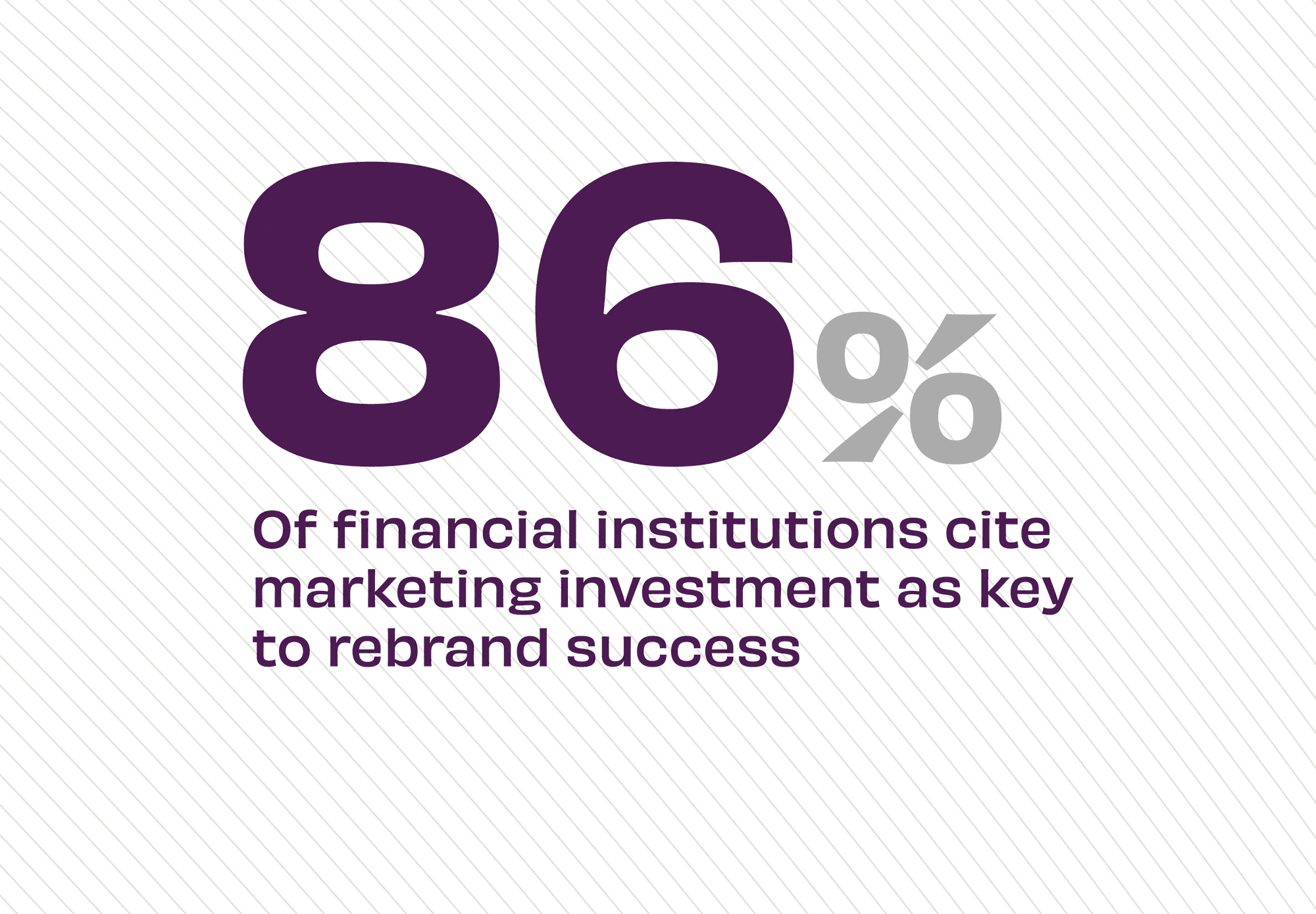

More than 8 out of 10 bank and credit union leaders say that strong marketing investment was critical to their rebrand’s success in both business impact and institutional influence. This focus on marketing is viewed as essential to delivering greater growth, according to data in the ROI of Rebranding, which finds marketing as one of the principal key performance indicators (KPIs) financial institutions measure to gauge the health of their brand. These findings about marketing post-rebrand come at a time when credit unions report increasing “marketing per member” over the past five years, going from $15 at year-end 2019 to $17 in 2024, according to Callahan & Associates and creditunions.com.

The Takeaway:

Prior to a rebrand, marketing was likely doing the heavy lifting for undifferentiated brands, according to Juliet D’Ambrosio, Chief Experience Officer at Adrenaline, on the Believe in Banking Podcast. She says, “Another way to think about that is how much your marketing has to spend on explaining the brand. Is it as effective as it can be? Does it have to spend an inordinate amount of time or effort establishing who you are? Or can the work of that happen with your brand to enable that awareness and ability for a prospect to pick you out and understand what you are about?” Post rebrand, marketing efforts can shift from growing awareness to engaging customers and prospects in a more meaningful way. According to Juliet, “One way we know that a new brand has been successful is that their marketing is more successful.”

Sources: Adrenaline, “Measuring the ROI on Rebranding Initiatives Survey,” May, 2024, Callahan & Associates, “Rebranding Post Pandemic,” March, 2024, and Believe in Banking Podcast, “Exploring the ROI of Rebranding,” May, 2024