The Story:

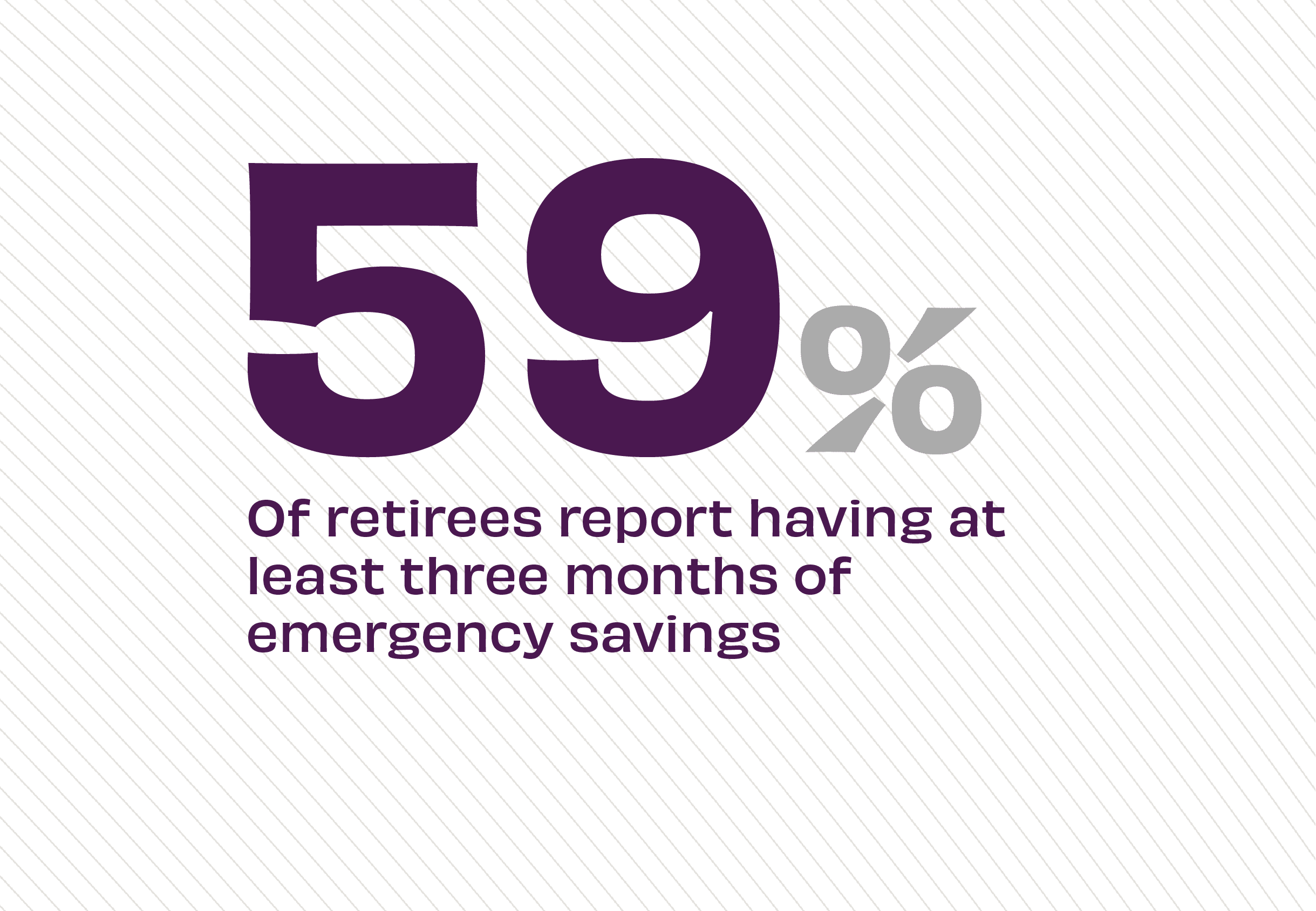

With persistent inflation and a high cost of living, many Americans struggle to save. In fact, one-third of Americans have higher balances on their credit cards than on their savings accounts, according to Bankrate. Having an emergency savings account is essential – especially for seniors in their retirement years – to be able to withstand any unexpected financial setback. And it turns out those setbacks are actually quite common. The Employee Benefit Research Institute finds 36% of retirees report experiencing unforeseen spending requirements during their retirement so far. But banking can help create financial stability and security for seniors.

The Takeaway:

Emergency savings accounts are just one way of preventing income loss for seniors. As older Americans move from employment earnings to fixed income, having tailored products and services and targeted advice will help seniors navigate their changing financial landscape. “The days of banks simply shifting older adults to ‘senior checking accounts’ are fading,” according to Bank Director. “Banks should take a more active role in engaging with older customers” to meet their needs. An effective engagement strategy includes not only financial products, but a combination of training and technology, along with customized content and counsel.

Source: Employee Benefit Research Institute, “Spending in Retirement Study,” November, 2024, Bankrate, “2025 Annual Emergency Savings Report,” February, 2025, and Bank Director, “5 Things Banks Can Do Right Now to Protect Older Customers,” May, 2023