World Bank reports that reducing barriers that prevent women from working or starting businesses would double the rate of economic growth over the next decade

New data from the World Bank finds that closing the gender gap alone would result in a sharp surge in global GDP. “Ending discriminatory laws and practices that prevent women from working or starting businesses could raise global gross domestic product by more than 20%,” according to Reuters reporting. This would double the rate of economic growth over the next ten years. “Women have the power to turbocharge the sputtering global economy,” according to World Bank chief Economist Indermit Gill. Reducing obstacles women face in the workforce, including barriers to starting businesses, would truly pay off for the worldwide economy.

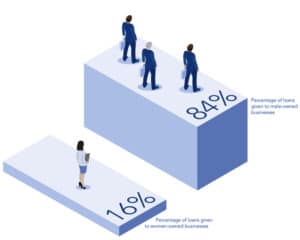

Though data finds that women entrepreneurs outperform men, only 16% of business lending goes to women in the U.S. “Even though men have a significant advantage in raising funds, companies founded or co-founded by women do better along several dimensions than companies started by men, according to Forbes. “Women founders tend to build businesses that generate more revenues, create higher job growth, dream bigger, and execute better.” Women are recognized as such a powerful economic force in the U.S. that the Small Business Association and banks and credit unions across the country are dedicating resources to better serving women-owned small businesses.

Reporting from the Financial Brand outlines several banks with signature initiatives targeted toward serving women business owners. KeyBank’s program Key4Women provides certified staff to help women entrepreneurs make better business decisions and foster financial confidence for their growing businesses. CNB launched its Impressia Bank division to help close the gender gap in funding for women-owned small businesses. “The reality is banks are not yet fully supporting the fast-growing ‘sheconomy,’” says Mary Kay Loftus, president of Impressia. The bank’s women-focused offerings are available at 47 branches across New York, Ohio, Pennsylvania and Virginia.

Two additional financial services providers were founded to focus exclusively on women’s banking needs. For Members Only Federal Credit Union is the first “Black-owned, woman-led, sorority-based, digital banking financial institution” in the country. And First Women’s Bank founded in 2021 has a laser focus on women’s economic empowerment. Backed by notable investors like Billie Jean King, Allyson Felix and Sophia Bush, First Women’s Bank is upfront with its purpose – “a strategic focus on women’s economy, serving women business owners and closing the gender-lending gap.” The bank ranked as one of Fast Company’s Brands That Matter in 2023.

If you’re a banking leader looking at serving more and serving better, get in touch with the banking and credit union experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.