The Story:

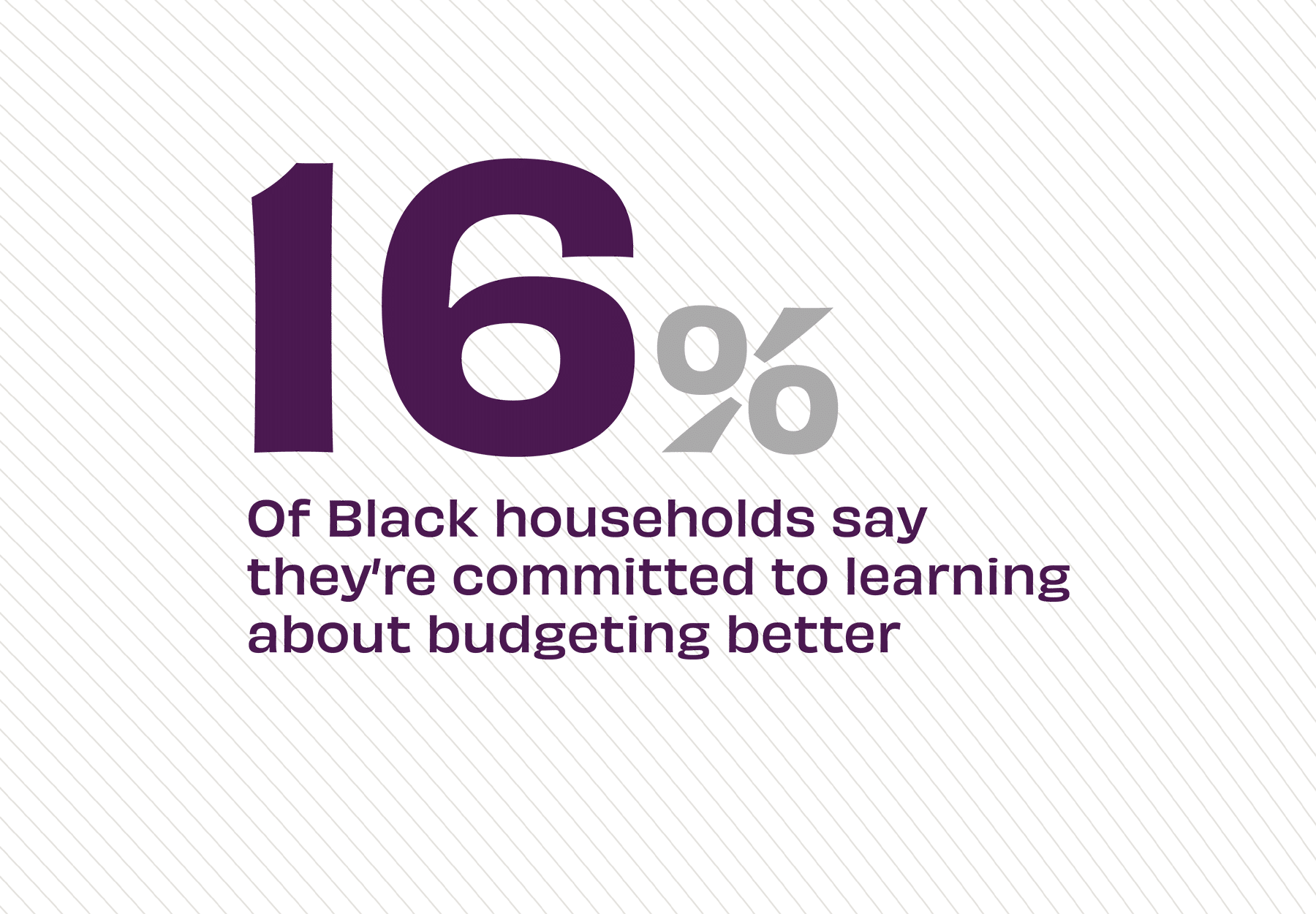

As racial disparities in the banking system persist, Black households are taking a proactive approach to making their money go further. Data from RFI Global and MacroMonitor finds that nearly one out of every six Black households is committed to learning how to budget better, compared to one in every ten white households. While people empower themselves, banks are stepping up, too. “Many U.S. banks and financial institutions are making significant strides to address disparities,” according to RFI Global’s article on financial inclusion. Banks are increasing access to banking, credit, and lending to foster homeownership and entrepreneurship. While fairer practices are foundational, that’s only the first step in reducing the wealth gap.

The Takeaway:

Expanding banking options for Black communities not only includes access to accounts and credit, but also financial literacy and money management tools. “While not a cure-all, increased financial literacy can lead to improved financial capability and practices that benefit even those with relatively low incomes,” according to the National Urban League. “Financial education plays a critical role in helping Black families build wealth and make informed financial decisions,” according to RFI Global. “Banks are investing in educational initiatives to empower communities with the knowledge needed to succeed.”

Source: RFI Global, “Breaking Barriers: The Banks That Are Supporting Black Financial Inclusion,” February, 2025, and National Urban League, “Disparities in African American Financial Literacy,” February 2025