As we approach Juneteenth’s commemoration of enslaved people’s freedom in the U.S., it’s a time to reflect on black advancement in all of American life. In financial services, the need for greater diversity drives much of the conversation around black economic opportunity. “The cultural movement to support Black-owned banks along with other African American businesses received a major boost in the aftermath of Floyd’s murder on May 25, 2020, as many corporate leaders and everyday Americans sought ways to address longstanding socioeconomic disparities,” according to CNN’s article on black-owned banks and community reinvestment.

In the last year alone, the National Bankers Association – a trade group representing minority-owned FIs – reports an estimated $150 million in capital has been invested in Black-owned banks. But capital tells only part of the story. While black financial services providers have a harder time securing funding, that’s not stopping the ranks of digital and fintech entrants into banking. “Unconstrained by geography, these financial institutions can extend their reach and solve previously unsolved problems for particular consumer groups,” according to Forbes’ exploration about digital banking and social change.

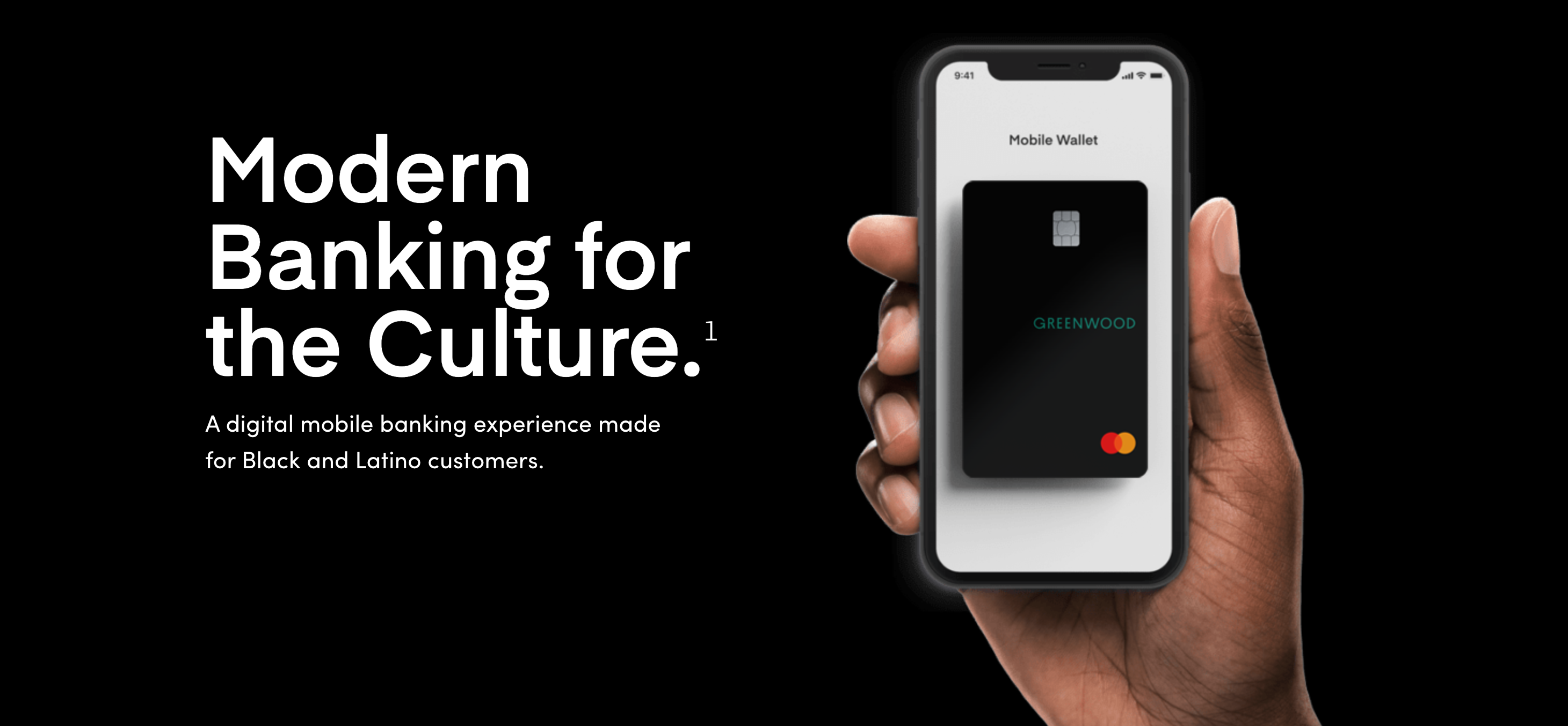

During PPP for example, black businesses were more likely to turn to neobanks and fintechs for lending than traditional banks, according to the Federal Reserve. And these digital upstarts are delivering. Minority-owned fintechs are exploding to support the financial needs of diverse communities. Whether it’s digital banking for black and Latinx consumers like Greenwood, debt pay-down apps like Qoins, or wealth-building like BREAUX Capital, digital is providing a platform of support for underserved and diverse communities, and the Mighty’s interactive tools or Simple Dollar’s listicles are helping empower consumer choice.

To learn more about serving underserved communities and how the financial industry can help build banking diversity, email info@adrenalinex.com.

Photo Credit: Greenwood Bank