The Story:

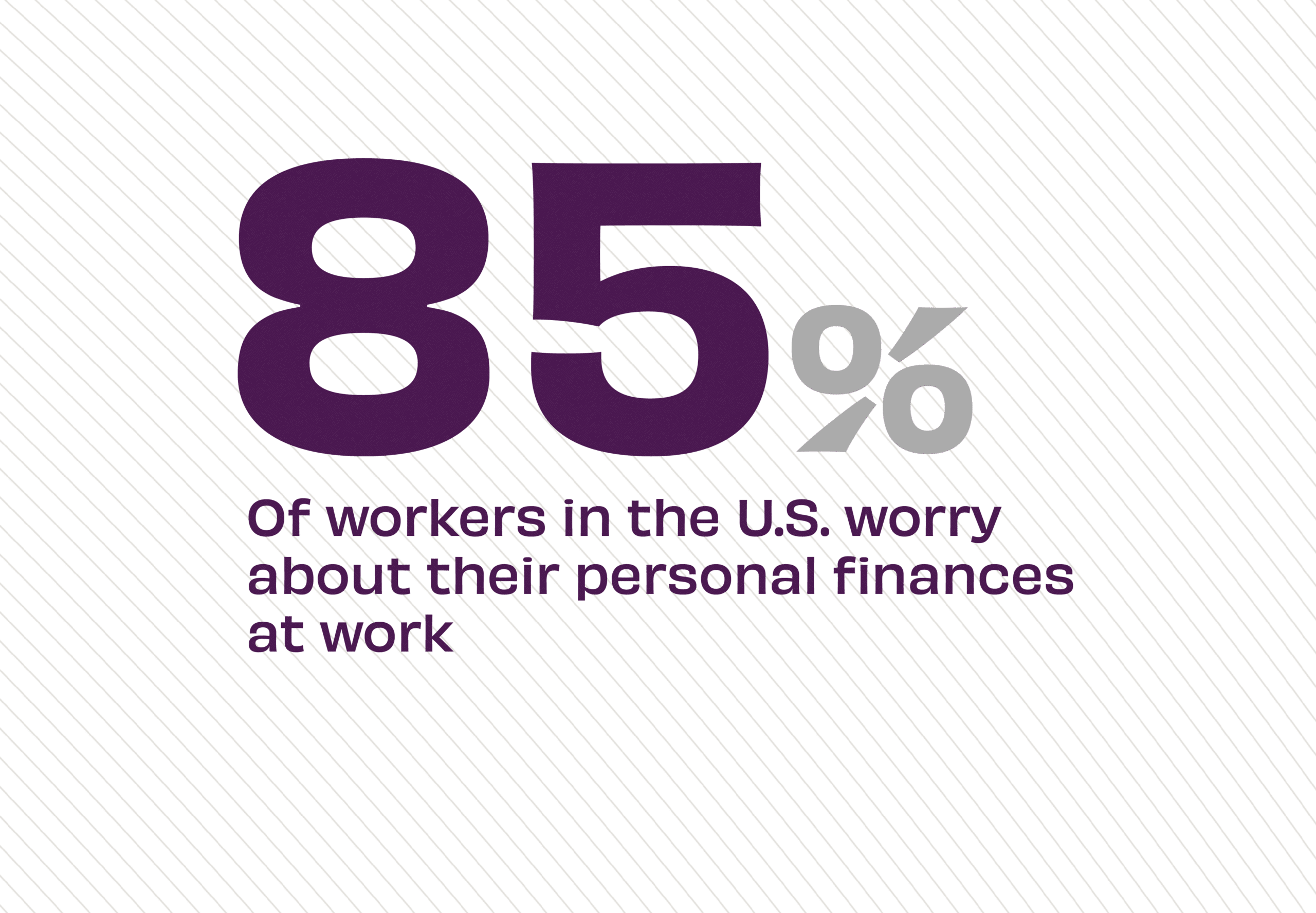

New data from PNC’s 2024 Financial Wellness in the Workplace Report finds that American workers spend up to three hours a week at work worried about their finances. That fact has not gone unnoticed by their employers, 78% of whom report that their employees are financially stressed. According to an HR professional quoted in the report, “If someone is not happy or not content, or if someone is stressed over money, we can’t expect that person to perform 100%, give 100% to the company and be efficient.” While financial worries can reduce productivity and workplace morale, there are financial solutions that can help.

The Takeaway:

The survey found that 4 out of 10 employees say financial education is a benefit they don’t have but want the most. And employers are answering the call. In the last year, access to financial planning benefits doubled for American workers, going from 14% to 28% of employees reporting that they have access to experts as they plan for their financial futures. “Companies want their employees engaged, not stressed over their finances,” says Sumeet Grover, chief digital and marketing officer at Alliant Credit Union, in U.S. News. The range of tools for employers is expanding, especially those backed by financial institutions. According to Grover, “We feel there are more tools now than ever” to help employers support their employees.

Source: PNC Bank, “2024 Financial Wellness in the Workplace Report,” August, 2024, and U.S. News, “Do Employer Financial Wellness Programs Really Work?” August, 2024