Following a sluggish 2023, experts see signs of renewed banking M&A activity into 2024

With four months remaining in 2023, banking experts see signs of rising bank mergers and acquisitions on the horizon, as financial institutions look for competitive ways to scale. M&A in the banking sector has been light for most of 2023 – amid economic uncertainty, rising interest rates and regional banking failures. “But bankers point to some potential catalysts that could jump-start consolidation,” according to American Banker. “People are still a little nervous,” says Chuck Sulerzyski, CEO of Peoples Bancorp, in an interview with the publication. The turnaround might not be immediate, but Sulerzyski says, “By the middle of next year, I think you will see a lot. I think there’s no doubt.”

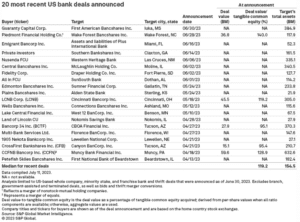

S&P data at the half-year mark in 2023 also backs up this assessment of the banking landscape. Though still not to 2022 levels, interest in bank mergers and acquisitions is on the rise. “Eight U.S. bank M&A deals were announced in June, bringing the 2023 year-to-date total to 41 deals.” With four months still left in the year, deals are just over half last year’s total, but the eight mergers announced in June alone were double the number of deals in May. Rather than a sign of distress in a tight economy, MarketWatch says, “Consolidation in fact may be healthy for the banking industry, especially as smaller regional banks continue to see deposit outflows and slowing loan growth.”

Smaller banks need mergers and acquisitions to be more to be competitive. “It’s long been said that the U.S. is overbanked compared with the rest of the world,” according to Barron’s. With 4,135 financial institutions in the U.S., the sector is a mix of big behemoths and smaller community banks. The upcoming wave of consolidations could “further shrink the middle group between the megabanks and community lenders” reports American Banker. Tom Michaud, CEO of investment bank Keefe, Bruyette & Woods, says “Banks want to get the benefits of breadth and the benefits of scale.” For smaller and medium-sized banks, increasing competition for customers always drives M&A.

“While today’s current events may make some leaders hesitant to take action,” according to the Forbes Finance Council, “history shows that M&A deals made during times of economic uncertainties tend to be successful.” That’s because there’s a longer-term strategy at play. “Banks are making strategic moves to navigate a changing industry,” according to Bain & Company. “We expect to see three types of strategic deals: scale deals for consolidation, scope deals to focus on the core, and deals for a new growth engine.” With clear strengths for existing banks, they use “scale benefits of the core business and of their client base to grow faster than a start-up could.”

If you’re a banking leader looking for help with brand strategy or branch conversions after M&A, get in touch with the experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.