The Story:

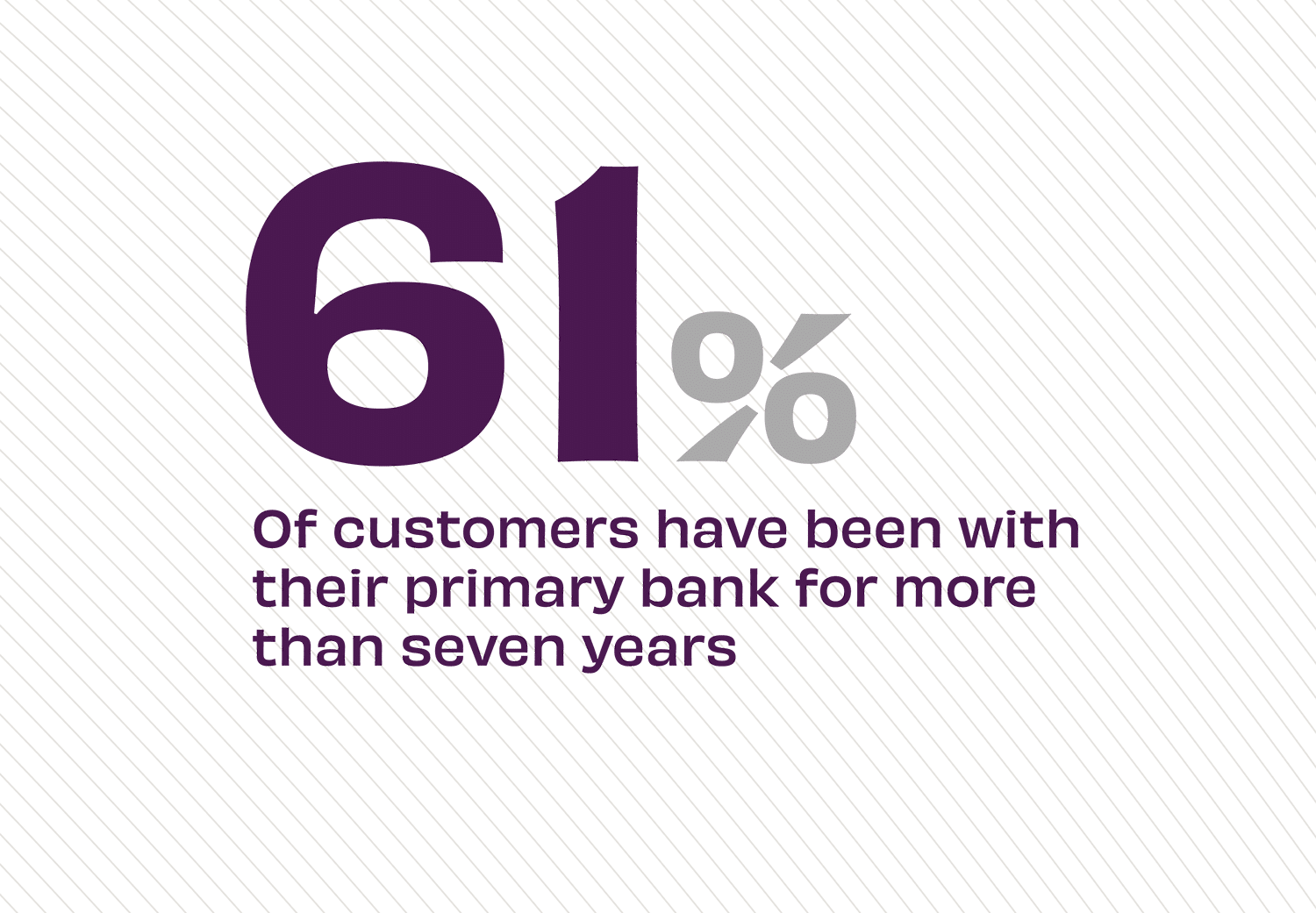

In an era of diversifying financial relationships, new data from Accenture finds that more than 6 in 10 customers have been with their primary bank or credit union for more than seven years. While people report a relationship with a primary financial institution as their main source of financial services, 73% of customers say they also do some banking with a competing financial services provider – averaging two bank accounts and two digital wallets per person. With this level of financial diversification, what can banks or credit unions to do deepen their existing relationships with current customers or members?

The Takeaway:

Accenture says long term banking relationships lean on “lazy loyalty,” where a customer has a banking relationship but doesn’t actively endorse or promote the bank to others. “What’s missing is advocacy,” according to the Forbes article, How Banks Can Replace Lazy Loyalty With Customer Advocacy. “Where enthusiastic customers believe their bank is working hard for their financial security and aren’t shy to tell others about it.” Forbes outlines four main drivers of customer advocacy – 1) trust and transparency 2) personalization and tailored advice 3) customer satisfaction and experience and 4) benefits and rewards. “Building customer advocacy is not the only a way to reignite the spark between customers and their banks, but it’s a crucial strategy for profitable growth.”

Sources: Accenture, “Banking Consumer Study,” March, 2025, and Forbes, “How Banks Can Replace Lazy Loyalty With Customer Advocacy,” March, 2025