Financial institutions provide programs for small-dollar loans and business banking solutions

Even as key economic indicators show signs of strength heading into the holiday season, government agencies and advocacy groups are calling on banks to further expand economic support for consumers and companies – especially with people leaning on credit cards and other forms of borrowing to deal with inflation. “The nation continues to grapple with historic economic headwinds and uncertainty ahead,” says Lindsey Johnson, president and CEO of the Consumer Bankers Association (CBA) in the recent BankThink article. “America’s leading banks remain focused on finding durable solutions to these issues over the next year.”

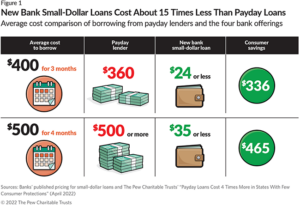

Those solutions include “meeting the small-dollar lending needs of consumers [and] expanding access to credit for small businesses,” according to Johnson. On the consumer lending front, more banks are stepping up to provide better small loan products as transparent and fairer alternatives to payday loans, which often have aggressive terms and compounding interest that create complications for borrowers. In fact, Pew research finds that “using payday loans can put customers at increased risk of losing their checking accounts.” But when surveyed, 80% of payday borrowers report they would switch to their bank for lending if given the option.

Now, seven banks have announced they currently offer or plan to provide smaller loans to consumers. The four biggest U.S. banks – Bank of America, Huntington, U.S. Bank, and Wells Fargo – are already offering fair flat-fee, small-dollar installment loans. That means “financial institutions that operate nearly 13,000 branches – about 18% of all U.S. bank branches – now provide automated and near-instant small-dollar loans to their customers,” according to the Pew Charitable Trusts. “This unlocks access to borrowing for many checking account customers with low credit scores who could not otherwise qualify for bank credit.”

On the commercial front, access to funds is especially important to small businesses as they operate without the support of the government’s PPP program. “Small businesses, employing nearly half of the nation’s workforce, continue to build back from years of pandemic-related restraints,” says CBA’s Johnson. With four in ten small businesses struggling to pay rent in October, she says it’s more important than ever to expand SBA, small-dollar and bank loans. “Policymakers in Washington must do more to bolster banks’ abilities to expand access to credit for the small businesses that are so integral to the fabric of Main Streets across this nation.”

Going beyond commercial lending needs alone, Wells Fargo has announced the launch of a one-stop shop for their business banking clients. “The digital banking portal, Vantage, creates customized experiences for clients ranging from early-stage startups to global corporations,” according to reporting from American Banker. Offering digital solutions, self-service transactions and banking support, Wells Fargo provides more tailored tools to allow business customers “to more clearly see their priorities and capabilities” with options that “adjust as companies grow or evolve and their needs change.” In short, banking at the point of need.

For the latest on banking programs for consumers and companies, stay tuned to Believe in Banking’s continuing coverage of top trends and topics. For the banking industry’s best practices, visit Adrenaline’s Insights. And if you’re a banking leader looking for brand to branch strategies customized for your institution, contact our banking and credit union experts via email at info@adrenalinex.com.