Taking cost out to put opportunity back into the branch network

In the recent Ask an Expert, Adrenaline’s Chief Experience Officer Gina Bleedorn explores concepts surrounding optimization, especially the central role of building efficiency into branch delivery. On taking cost out of the branch network, Gina talks about how reducing the cost of servicing physical transactions is critical to weather this storm. Although as the first step, it’s not reduction or even banishing inefficiency that matters most; it’s redirecting cost savings into investment to grow.

For banks in this moment: Now is not the time to roll over, but to dig in and fight to survive and thrive by capitalizing on the real value of your branches as your greatest source of trust and new business opportunity.

Grow to Survive

Sean Keathley, Adrenaline’s President and CEO, describes the opportunity banking has in this moment – an enforced pause – to reevaluate their branch network. He says, “The pressures banking is experiencing right now are not purely because of the pandemic. Many of the pain points have been building over time.” Because the industry has been relatively slow to adopt market data-based decision-making about branches, growing inefficiencies have compounded a lack of market opportunity, especially in smaller markets.

Inefficiencies like lack of universal staffing and under-utilization of remote physical service like drive-up ITMs have real-world impacts for financial institutions. Sean continues, “Because branches aren’t optimized, closures and staffing issues have continued to go unaddressed. Now, they’ve come into sharper focus because of the pressures of COVID.” In short, taking out inefficiencies in branches will allow banks the opportunity to meaningfully reinvest into a more optimized and growth-oriented branch model primed for the future.

At the same time, banks are focused on optimizing current branch networks, they also need to be looking at growth markets to expand into with new branch formats and potential mergers and acquisitions. For many community banks and credit unions, deposit bases in core legacy markets have been drying up –even before the crisis – due to urbanization, digitization, and an economy that was already beginning to contract. New markets will allow banks to build new relationships with new customers, which is how they will grow.

“It’s not about declining branch transactions. It’s reducing transaction costs, so banks will have more to invest in advising and consulting – that’s the real future face of financial services.”

~ Gina Bleedorn, CXO of Adrenaline

Reshaping Banking’s Future

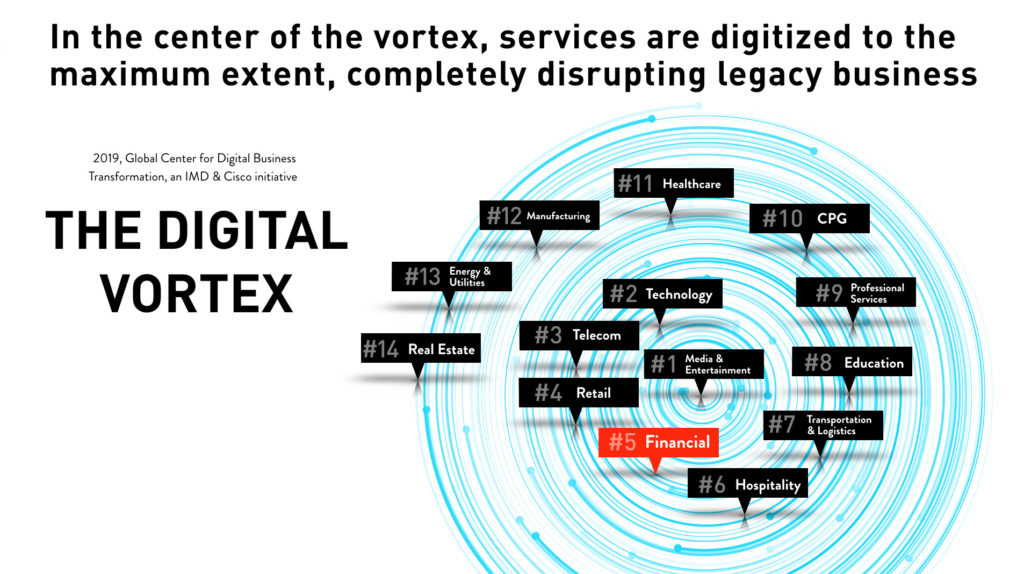

Now that banking is working through their COVID reopening phase, banks and credit unions must simultaneously focus on reshaping their future. Pre-COVID, digital pressures were already bearing down on banking as evidenced by the Digital Vortex – a model representing digital disruption across industries in the U.S. The vortex represents both industry and consumer, a snapshot of how innovative an industry is and how willing consumers are to embrace that innovation. In the center of the vortex, all aspects of a business have been digitized.

Across all sectors in varying degrees, the pandemic is forcing faster change by both industry and consumer. With COVID, consumers have to use more digital and remote channels for transactions, whether they’ve wanted to or not. For banking, that meant building more robust digital delivery and scaling it quickly. Just because there is digital disruption rippling across the financial services sector that doesn’t mean that bank branches are going to start disappearing. Digitization – even at the center of the vortex – does not translate into physical channels going away. Rather, they reshape.

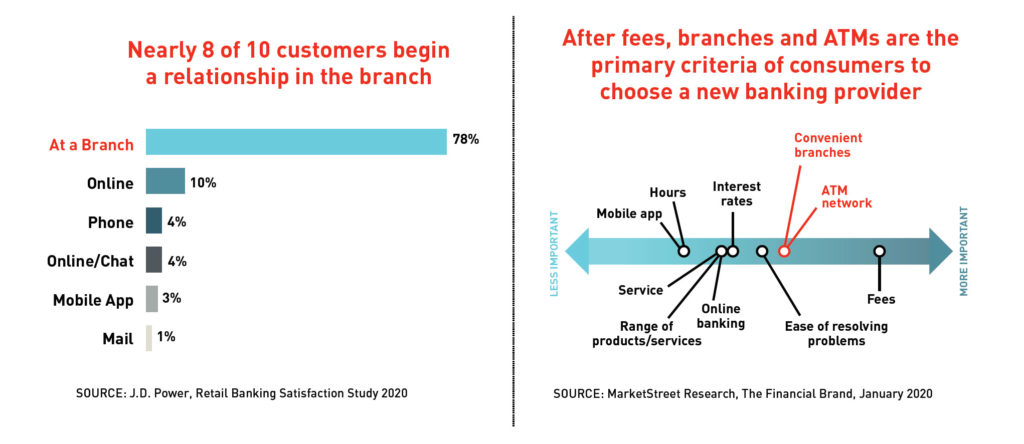

Pre-COVID (as of January 2020), 78% of all consumers opened a new account in a physical branch and after fees, branches and ATMs were the top criteria driving banking consideration. Immediately post-COVID, 55% of account openings are still happening at the branch level – although that number dropped 10 percentage points in one year. Novantas points out that in March, 20-25% of bank branches were largely unaffected from a transactions standpoint, although overall volumes were down 12% and sales were down 67% at the branch level. This data illustrates that moving forward banks should recognize that conditions vary widely and a one-size-fits-all branch approach will not work.

The Future is Now

While we all seem to know that the pandemic is quickly pushing the industry toward change, what we don’t know is how fast change is going to happen. After COVID subsides, will banking snap back to its pre-COVID norm, as this Novantas survey suggests with 53% of consumers planning to return to the branch? Or will the pandemic-forced adoption of digital channels change consumer banking behavior forever? The truth probably lies somewhere in the middle.

In our next weekly feature, we’ll dive into the spectrum of future-banking scenarios and address how financial institutions can make future-proof reinvestments for growth. If you need help preparing your staff for post-COVID branch operations, see our Frontline Staff Engagement Training series. If you are a financial institution needing advice and expertise now, contact Adrenaline’s financial services experts at info@adrenalinex.com or call (678) 412-6903.