A look at tailored financial solutions for growing small business strength as black women continue to close the gender gap in the U.S.

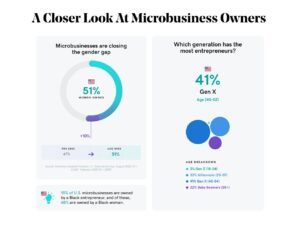

As the country recognizes National Small Business Week, recent data from the Venture Forward initiative finds that black women are closing the gender gap in the small business sector. More than doubling their ranks in five years, black women are the fastest growing group of entrepreneurs in the U.S. “Overall, entrepreneurship is becoming more diverse,” according to a press announcement. “With 29% of U.S. microbusinesses now owned by respondents identifying as Black, African American, Asian, Pacific Islander, American Indian, Alaska Native or multiracial entrepreneurs, compared to 17% in 2019.” But as businesses become more diverse, are the tools to grow meeting their needs?

When JPMorgan Chase studied 835,000 small businesses, they found “notable disparities between the growth trajectories of small businesses led by white owners and those led by underrepresented demographic groups,” according to the Financial Brand. Scale matters for small businesses, as those enterprises reaching $1 million in revenue often have more access to capital to fuel future growth. “While banks and other financial institutions may not be positioned to meet all small business financing needs, innovative efforts to service female business owners and business owners of color could help these businesses get a stronger start.”

Also revealing funding needs, McKinsey’s in-depth research of small business owners recommends banks go even further. “One of the key takeaways was that banks should consider becoming a one-stop shop for all kinds of products and services valued by small and medium-size enterprises,” according to McKinsey’s analysts. “Clients say they would welcome such convenience but generally aren’t getting it from their primary financial institutions.” The management consultancy says that small business customers represent a “cornerstone of liquidity strength and financial stability” for institutions, as these businesses keep “their money parked where it is” even in tough times.

One of the biggest ways banks can support small businesses of all types is to provide end-to-end cashflow management. “Enterprises of all sizes make wide use of core payments and collections solutions, credit card services, and cash and treasury management workflow solutions,” according to McKinsey. However, about a third of businesses still use institutions other than their bank for more complex financial services. And though 57% of small business banking customers currently get financial advice from their bank, they want more according to ABA Banking Journal, especially tailored guidance in spending and saving and how to help the business improve its credit score.

If you’re a banking leader wanting to deliver better experiences, get in touch with the banking and credit union experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.