The Story:

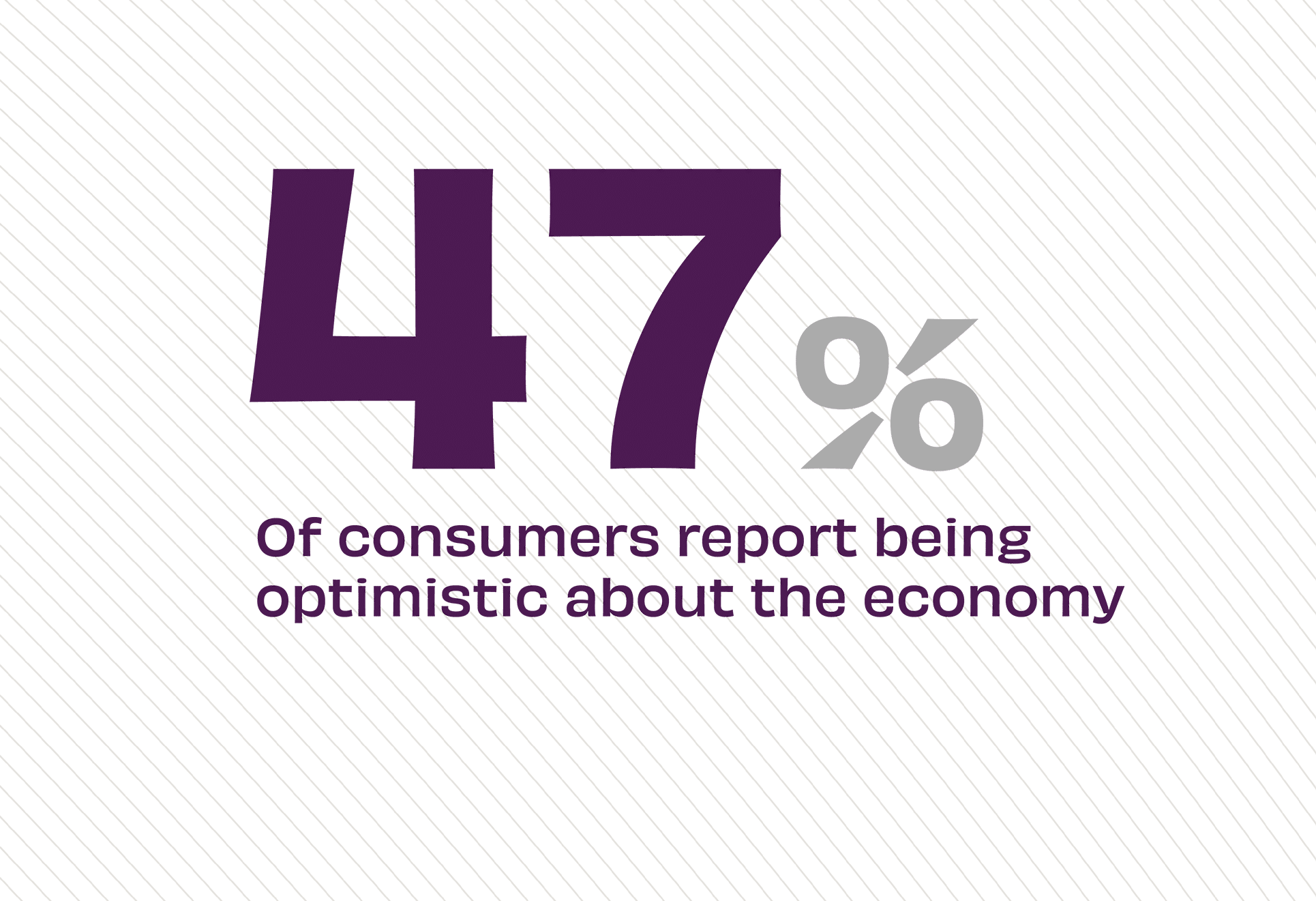

New data from McKinsey finds that consumer optimism about the economy rose six percentage points in the fourth quarter of 2024, reaching its highest level over the past five years. The sentiment was driven largely by positive economic developments, like a stock market rally and a strong jobs report in December that sharply beat expectations. “This rise in optimism spanned all income levels and genders,” according to McKinsey & Company. “Though more baby boomers and Gen Xers than younger consumers reported feeling optimistic.” While consumers are more upbeat overall, does that mean they’ll spend or save more?

The Takeaway:

Even when consumers have been more pessimistic, their spending patterns haven’t necessarily moved in lockstep with expectations. “It appears we’ve entered a new chapter in consumer behavior: the era of the ‘value now’ consumer,” according to McKinsey. That means consumers are still spending but doing so to get the greatest benefit to their lives. “With sentiment no longer being a sure predictor of spending, [brands] need a new, clear way to get an accurate picture of consumer preferences and behavior.” For financial institutions, encouraging smart spending and saving habits will be key to supporting consumers, regardless of fluctuations in the current outlook.

Source: McKinsey & Company, “Update on U.S. Consumer Sentiment,” December, 2024 and McKinsey & Company, “The ‘Value Now’ Consumer: Making Sense of U.S. Consumer Sentiment and Spending,” January, 2025